Investment Options for Business Owners in Faridabad (2026 Guide)

February 18th, 2026 News

Why Business Owners in Faridabad Need a Different Investment Strategy

If you are a business owner in Faridabad, your financial life is very different from salaried professionals.

✔ Irregular income

✔ Business risk exposure

✔ High tax liability

✔ Limited time for investment management

✔ Need for liquidity

Areas like Sector 15, Sector 21C, Sector 31, and Greater Faridabad have seen strong business growth — but many entrepreneurs still lack structured personal wealth planning.

Your business generates income.

But your investments create long-term security.

7 Best Investment Options for Business Owners in Faridabad

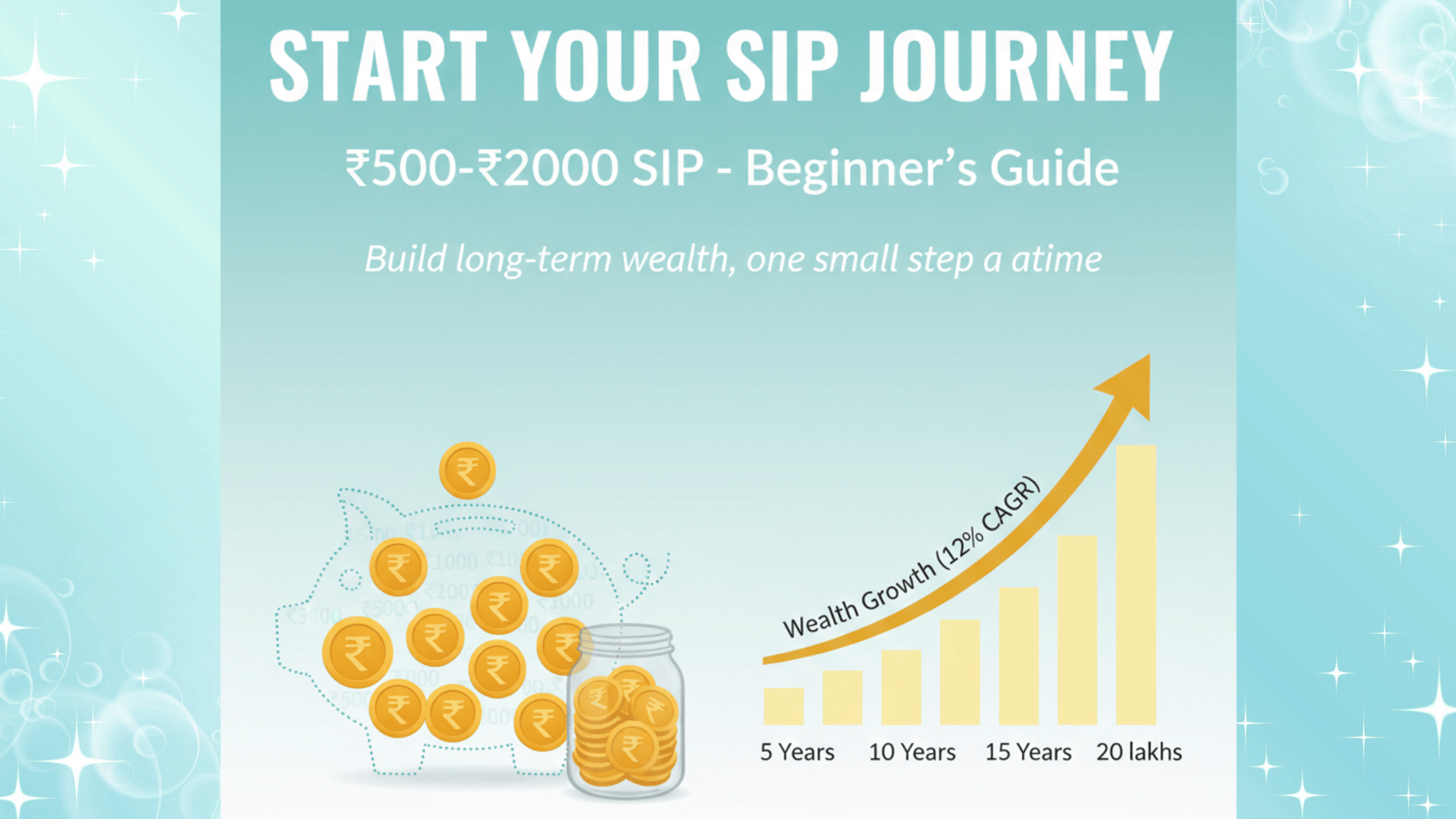

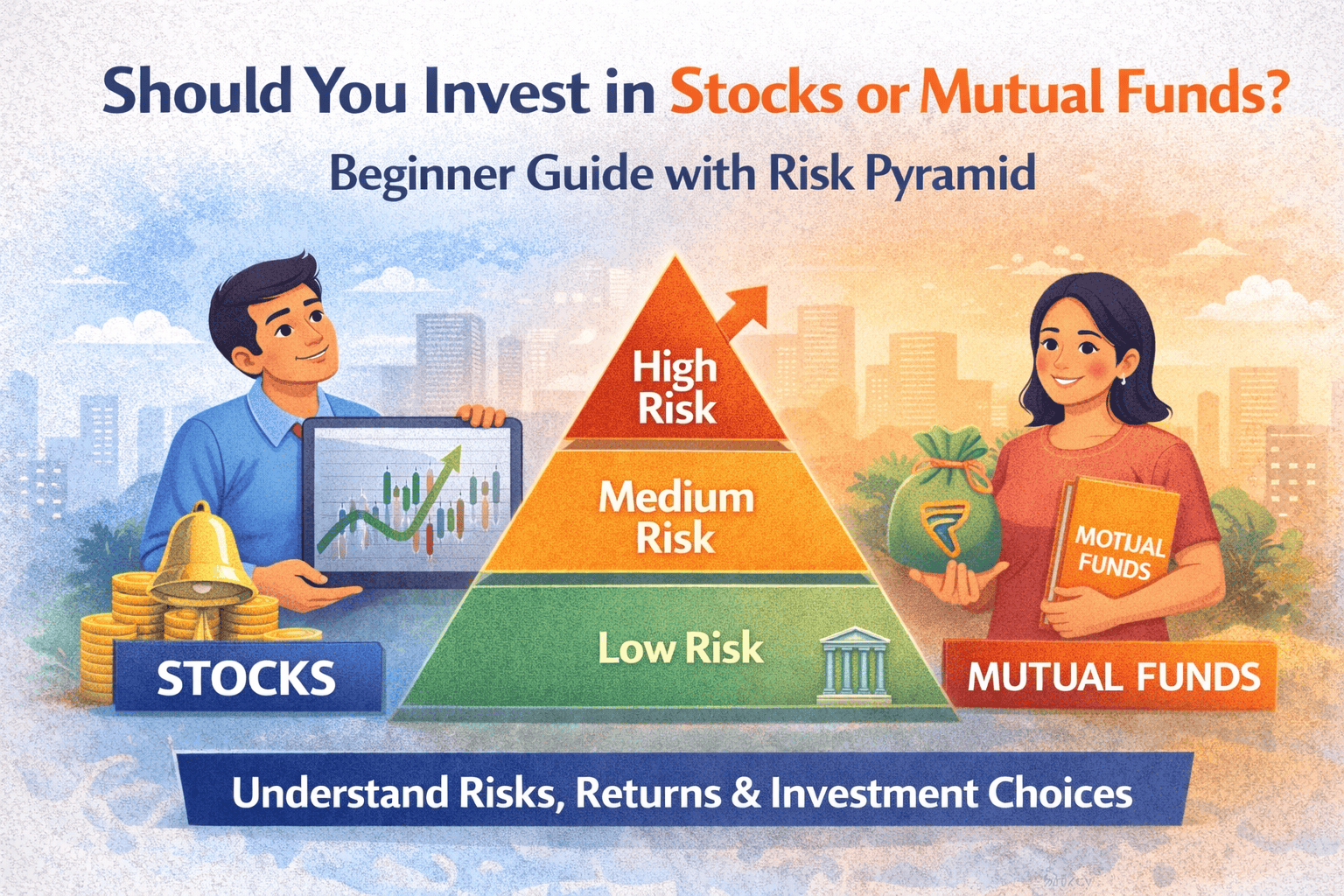

1️⃣ Equity Mutual Funds (Long-Term Wealth Creation)

Ideal for business owners who:

-

Want higher long-term returns

-

Can tolerate market volatility

-

Plan for retirement or generational wealth

SIP or lump sum strategies work well depending on cash flow cycles.

2️⃣ Portfolio Management Services (PMS)

For high net-worth individuals (HNIs) in Faridabad:

-

Personalized portfolio strategy

-

Professional fund management

-

Concentrated high-growth approach

Best suited for investment portfolios above ₹50 lakh.

3️⃣ Real Estate in Faridabad

Commercial and residential properties in:

-

Greater Faridabad

-

Sector 79–89 growth corridor

-

Industrial areas

Real estate offers rental income + appreciation but requires careful liquidity planning.

4️⃣ Tax-Saving Investments

Business owners often fall in the highest tax slab.

Smart tax-saving options include:

-

ELSS Mutual Funds

-

NPS

-

Tax-efficient debt funds

-

Insurance-linked strategies

Proper tax planning can save lakhs annually.

5️⃣ Fixed Income & Debt Instruments

To balance risk:

-

Corporate bonds

-

Debt mutual funds

-

Fixed deposits

Important for capital protection and liquidity.

6️⃣ Alternative Investments (AIFs, Private Equity)

Suitable for experienced investors seeking:

-

Diversification

-

Higher potential returns

-

Lower market correlation

Requires professional advisory.

7️⃣ Retirement & Succession Planning

Many Faridabad business owners:

-

Reinvest profits back into business

-

Ignore retirement corpus

-

Have no succession plan

Your business is not your retirement plan.

You need:

✔ Separate retirement investments

✔ Emergency corpus

✔ Wealth transfer strategy

✔ Will & estate planning

Common Mistakes Business Owners Make

🚫 Investing only in own business

🚫 No asset allocation

🚫 No diversification

🚫 Ignoring personal financial planning

🚫 Delaying retirement strategy

A proper financial plan separates:

Business Assets vs Personal Wealth

How Much Should Business Owners Invest?

As a rule of thumb:

-

20–30% of annual profits should go toward diversified investments

-

At least 6–12 months of personal expenses as emergency fund

A structured plan ensures you are building wealth outside your business.

Why Work With a Financial Planner in Faridabad?

Local understanding matters.

A Faridabad-based advisor understands:

-

Local business ecosystem

-

Real estate trends

-

Tax environment

-

HNI requirements

Personalized wealth planning gives clarity, growth, and security.

Get a Free Investment Strategy Session (Faridabad Business Owners Only)

We offer:

✔ Personalized portfolio review

✔ Tax optimization strategy

✔ Retirement corpus planning

✔ Risk assessment

✔ Asset allocation design

📍 Available for business owners in Faridabad & Greater Faridabad

👉 Book Your Free Consultation Today

FAQs

What is the safest investment for business owners?

A mix of debt instruments and diversified mutual funds ensures safety and growth.

Should business owners invest in real estate?

Yes, but only as part of diversified allocation, not the entire portfolio.

How do I reduce tax legally?

Through structured financial planning using ELSS, NPS, insurance, and capital gain strategies.

Final Thoughts

Running a successful business in Faridabad is just the first step.

Building personal wealth outside your business is the real financial security.