Child Education Planning in India: Managing Cost, Inflation and Investments Smartly

February 16th, 2026 News

Child Education Planning in India: Cost & Investment Strategy

Every parent dreams of giving their child the best education possible.

But here’s the reality most families ignore:

📈 Education costs in India are rising faster than normal inflation.

An engineering degree that costs ₹15 lakh today could cost ₹40–50 lakh in 15 years.

Medical education can cross ₹1 crore.

Even quality undergraduate programs are becoming expensive.

If you don’t plan early, funding your child’s education can:

-

Disturb your retirement

-

Force high-interest loans

-

Create financial stress

This complete guide will help you understand:

-

Future education costs in India

-

Impact of inflation

-

How much corpus you need

-

Best investment strategy (SIP-based approach)

-

Mistakes to avoid

-

How to balance retirement and education planning

Let’s begin.

Why Child Education Planning Is Important in India

India has one of the fastest-growing education cost curves in the world.

Private universities, foreign education exposure, coaching classes, skill programs — everything is becoming expensive.

Most parents make one mistake:

They start planning only 4–5 years before college.

By then, it becomes financially difficult.

Child education planning works best when:

✔ You start early

✔ You invest systematically

✔ You consider inflation

✔ You separate goals

The earlier you start, the lower the monthly burden.

Understanding Education Inflation in India

Normal inflation in India is around 5–6%.

But education inflation?

👉 8–12% per year.

That means education costs double approximately every 6–8 years.

Let’s understand with an example:

Current Engineering Cost: ₹20 lakh

Time horizon: 15 years

Inflation assumed: 10%

Future cost after 15 years:

₹20 lakh becomes approximately ₹83 lakh.

This surprises most parents.

That’s why simple savings in FD or savings account is not enough.

Your investments must beat education inflation.

Step 1: Estimate Future Education Cost

Start by identifying:

-

Type of course (Engineering, Medical, MBA, Abroad, etc.)

-

Whether India or overseas

-

Current average cost

Approximate current costs in India:

Engineering: ₹10–25 lakh

Medical (Private): ₹50 lakh – ₹1 crore

MBA: ₹15–30 lakh

Study Abroad (US/UK): ₹50 lakh – ₹1.5 crore

Now adjust it for inflation.

If your child is 3 years old, and college starts at 18:

You have 15 years.

Multiply current cost using 8–10% inflation to estimate future requirement.

This gives you a realistic target.

Step 2: Decide Your Investment Time Horizon

Time horizon defines risk level.

If your child is:

Age 1–5 → 13–17 years horizon (High equity possible)

Age 6–10 → 8–12 years horizon

Age 11–14 → 4–7 years horizon (Gradually reduce equity)

Longer horizon = Higher equity allocation possible.

Shorter horizon = More conservative approach needed.

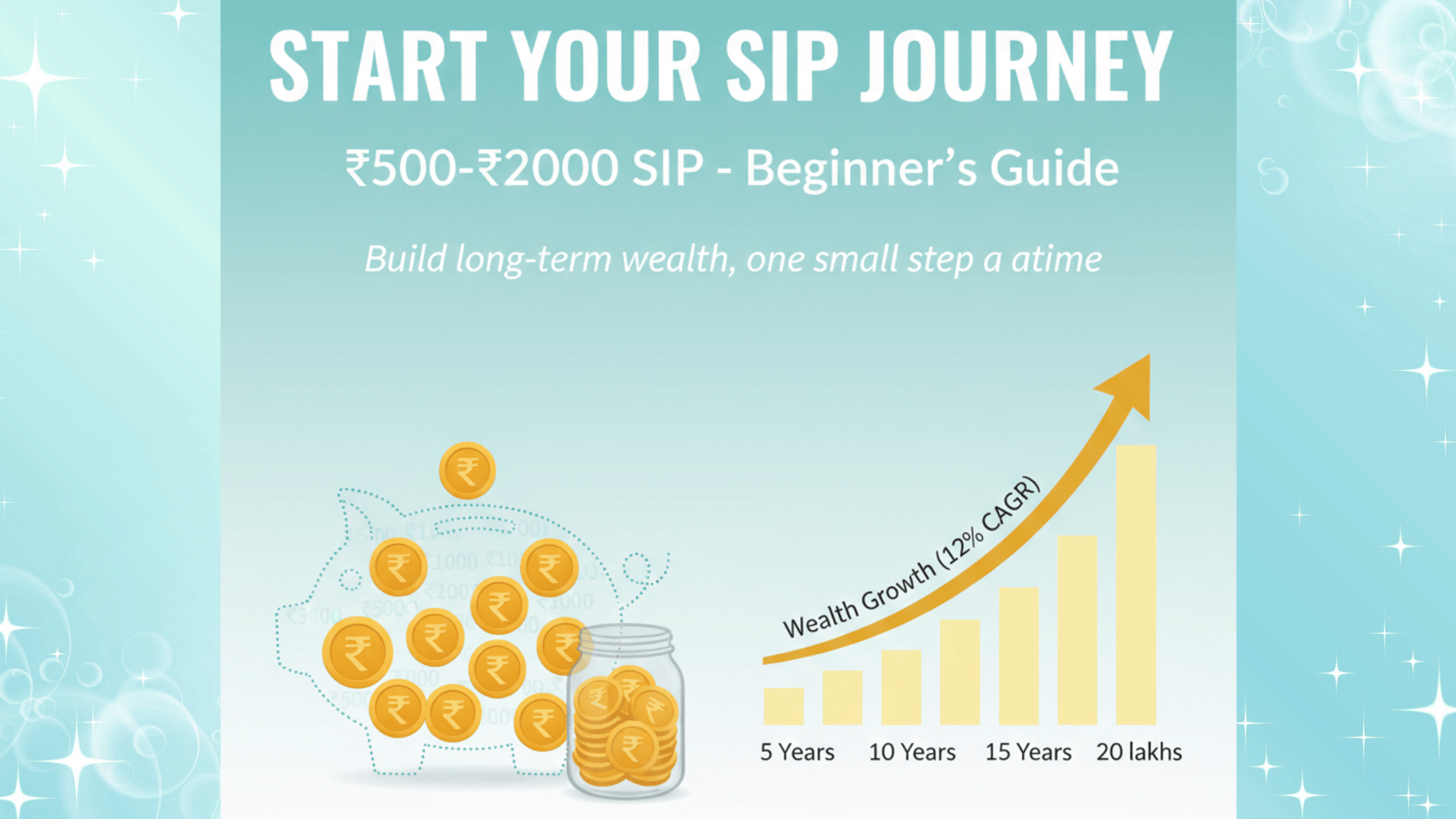

Step 3: Calculate Required Monthly Investment (SIP)

Let’s assume:

Goal: ₹75 lakh

Time: 15 years

Expected return: 12% annually

Required SIP ≈ ₹15,000–18,000 per month.

If you delay by 5 years:

Same goal

Time: 10 years

Required SIP jumps to ₹30,000+ per month.

This shows how delay increases financial pressure.

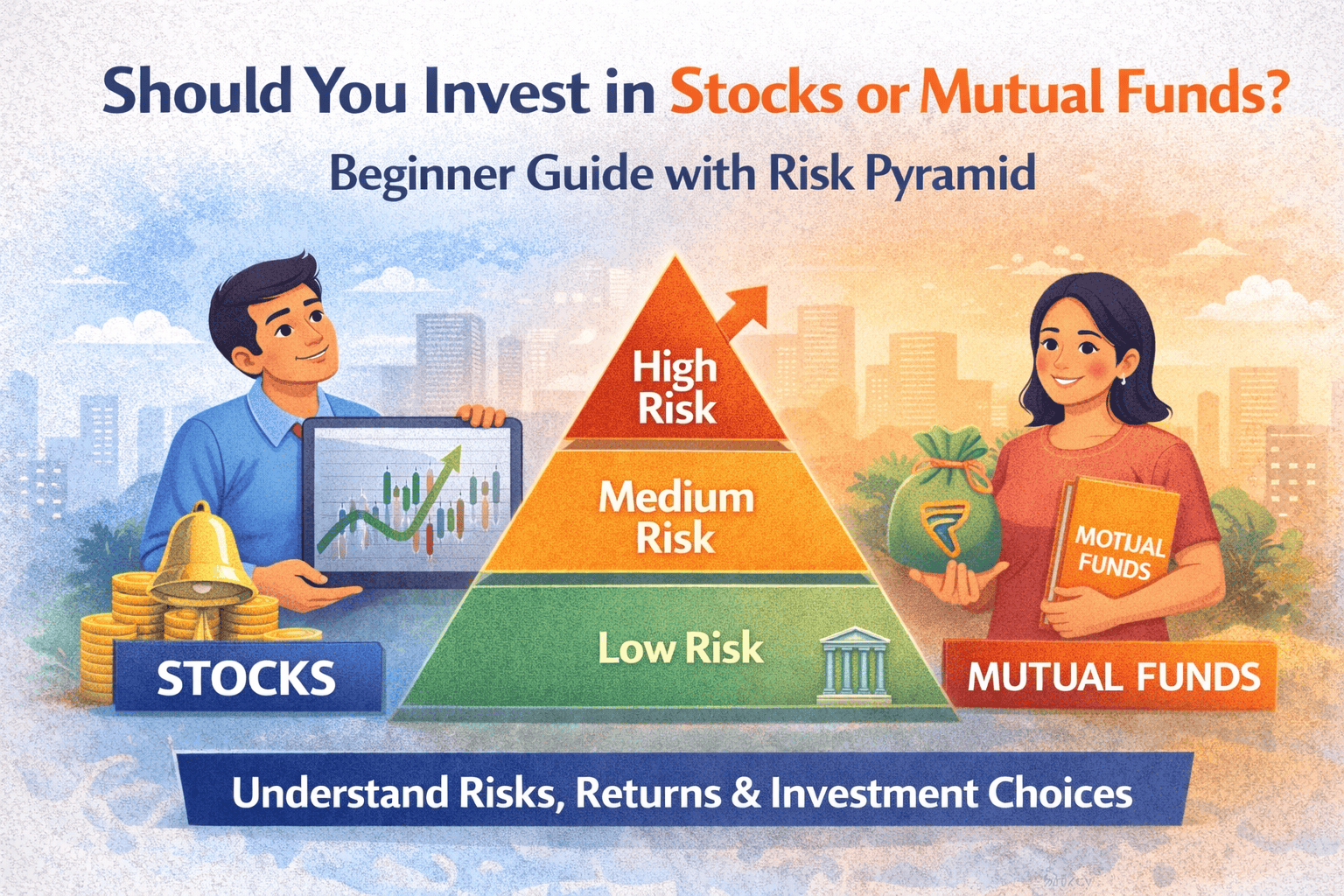

Step 4: Best Investment Strategy for Child Education

Since education is a long-term goal, you need growth-oriented investments.

Ideal Strategy:

1️⃣ Equity Mutual Funds (60–80%)

-

Large-cap funds

-

Flexi-cap funds

-

Index funds

-

ELSS (if tax saving needed)

SIP is the best mode.

Equity helps beat education inflation.

2️⃣ Debt Allocation (20–40%)

-

Short-term debt funds

-

PPF (if long horizon)

-

Recurring deposits (for short-term goal)

Debt reduces volatility near goal time.

3️⃣ Gradual De-Risking Strategy

5 years before goal:

Start shifting equity to debt gradually.

This protects your corpus from market crashes just before college admission.

Should You Buy Child Insurance Plans?

Many parents buy traditional child plans from insurance companies.

But let’s analyze:

❌ Low returns (5–6%)

❌ High charges

❌ Lock-in periods

❌ Limited flexibility

Smarter approach:

✔ Buy term insurance separately

✔ Invest through mutual fund SIP

Insurance + investment should not be mixed.

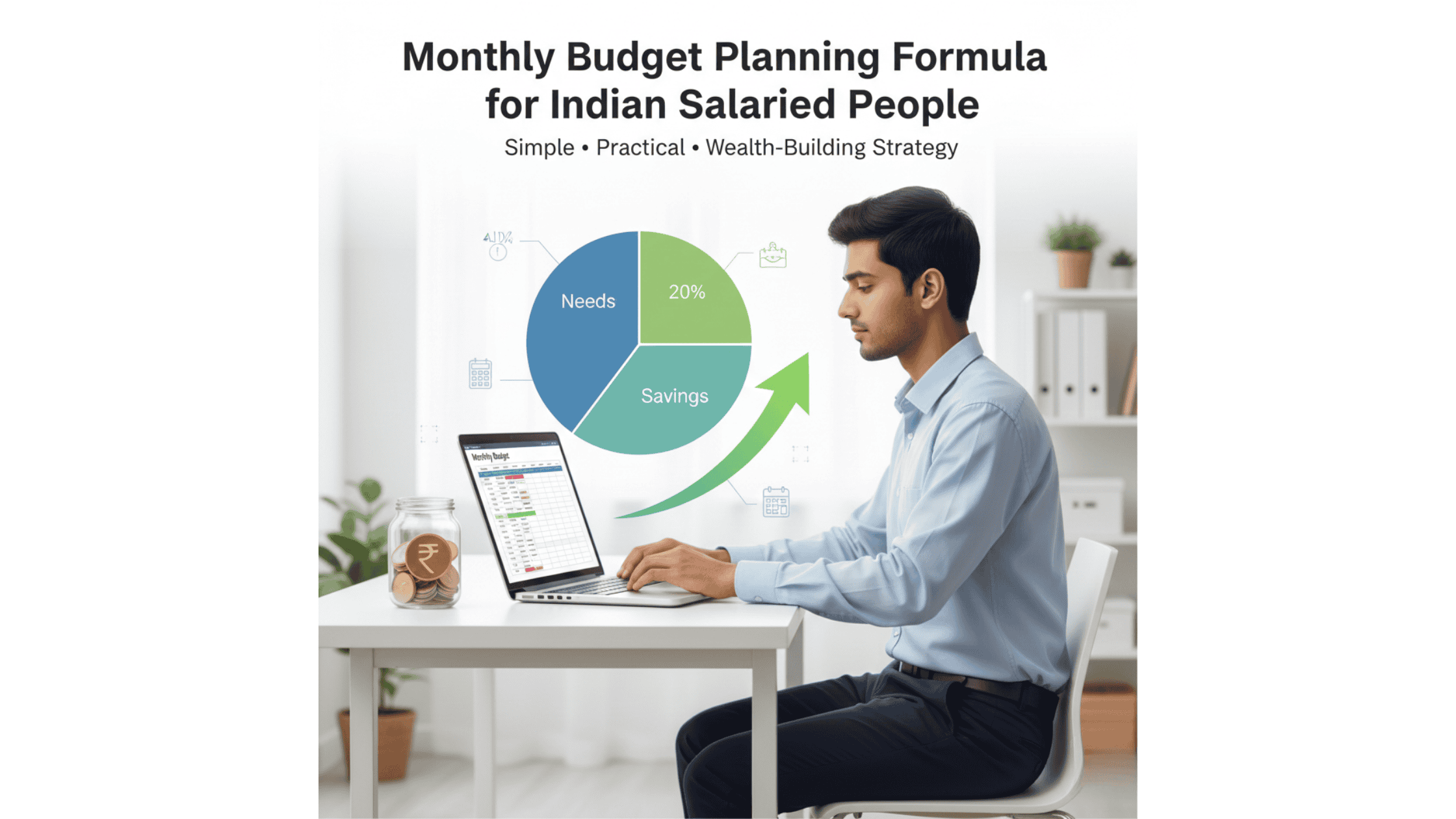

How Much Should You Allocate from Income?

General thumb rule:

Invest 10–20% of income for child education goal.

Example:

Income: ₹1 lakh per month

Education investment: ₹10,000–20,000

If you start early, even ₹5,000–10,000 SIP can grow significantly over 15–18 years.

Balancing Retirement & Child Education

This is critical.

Many parents sacrifice retirement completely for children.

But remember:

Your child can take an education loan.

You cannot take a retirement loan.

Priority order should be:

1️⃣ Emergency Fund

2️⃣ Health & Term Insurance

3️⃣ Retirement Planning

4️⃣ Child Education Planning

Both goals are important — but retirement must not be ignored.

Common Mistakes Parents Make

❌ Starting too late

❌ Underestimating inflation

❌ Investing only in FD/PPF

❌ Not reviewing plan annually

❌ Stopping SIP during market crash

❌ Mixing education and retirement funds

Avoiding these mistakes improves goal success.

What If Markets Crash Before College?

This is why asset allocation matters.

If you remain 100% in equity till the last year, risk increases.

That’s why professional planning involves:

✔ Rebalancing

✔ Gradual de-risking

✔ Annual review

Markets fluctuate. Planning reduces panic.

Education Planning for Studying Abroad

If your goal includes foreign education:

Consider:

-

Currency fluctuation

-

Visa costs

-

Living expenses

-

Travel

-

Accommodation

In such cases, corpus requirement is much higher.

Investment plan must be more aggressive in early years.

When Should You Start Child Education Planning?

Best time?

The day your child is born.

Second best time?

Today.

Even if your child is 10 years old, structured planning can still help.

Delay increases burden. Early start reduces pressure.

Role of Goal-Based Financial Planning

Instead of random investing, goal-based planning ensures:

✔ Specific target

✔ Specific timeline

✔ Specific asset allocation

✔ Progress tracking

✔ Adjustments when income changes

This increases confidence and discipline.

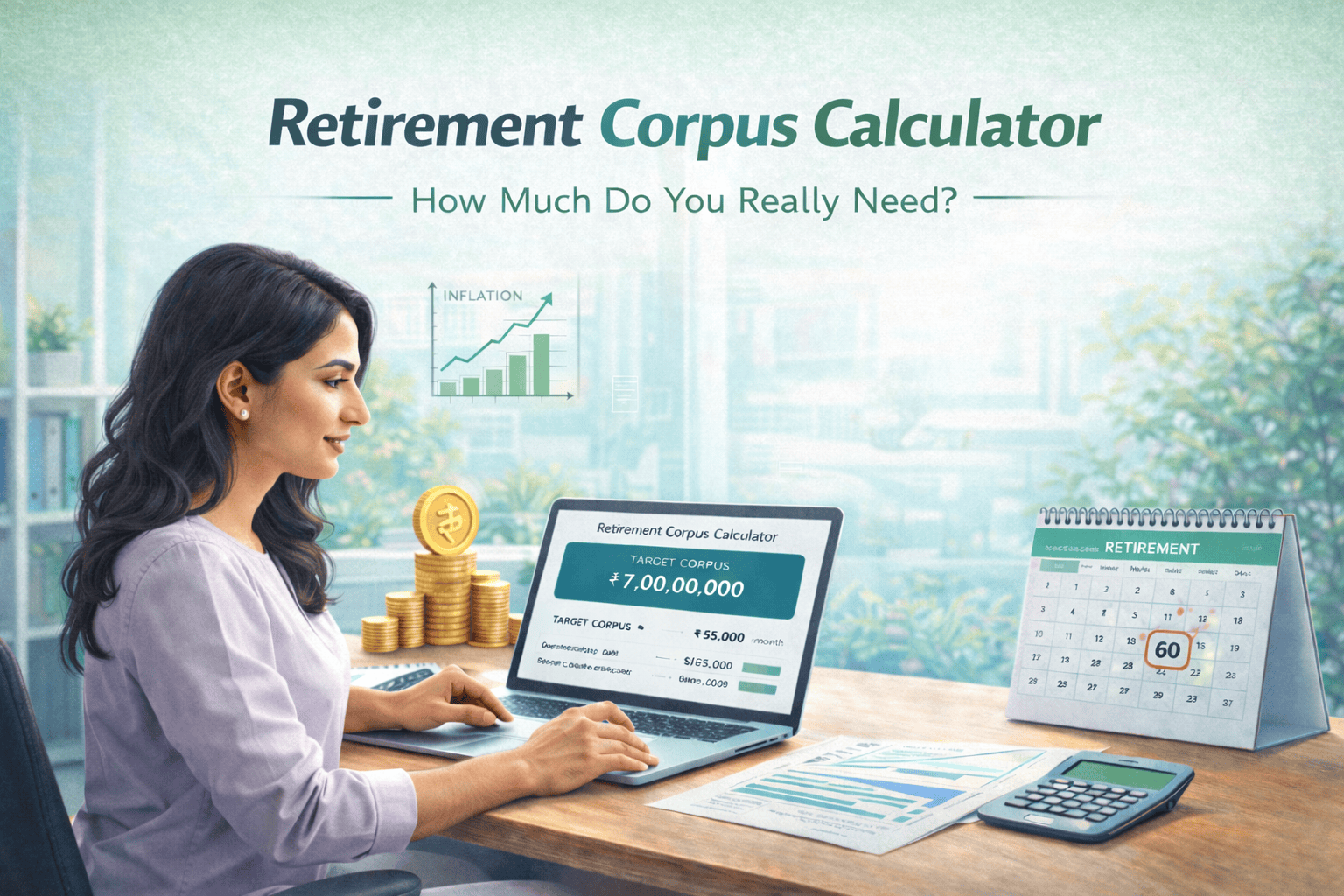

Real Example Case Study

Parent Age: 32

Child Age: 3

Goal: Engineering in India

Time: 15 years

Target corpus: ₹70 lakh

Strategy:

₹14,000 monthly SIP

12% expected return

Projected corpus ≈ ₹70–75 lakh

If SIP increases 10% annually:

Corpus can cross ₹90 lakh.

Small discipline → Big impact.

How Often Should You Review the Plan?

Minimum once every year.

Review checklist:

✔ Has income increased?

✔ Has goal cost changed?

✔ Is asset allocation balanced?

✔ Is SIP step-up applied?

Annual review keeps plan on track.

Child Education Planning Checklist

Before starting:

☑ Estimate future cost

☑ Calculate corpus

☑ Decide SIP amount

☑ Choose right funds

☑ Create emergency fund

☑ Buy term insurance

☑ Review yearly

Simple checklist. Powerful results.

Final Thoughts

Child education planning in India is not optional anymore.

It’s a necessity.

Education inflation is real.

Costs are rising rapidly.

Loans are expensive.

But with:

✔ Early start

✔ Proper SIP strategy

✔ Asset allocation discipline

✔ Annual review

You can build a secure education fund without financial stress.

The goal is not just saving money.

The goal is giving your child opportunities — without compromising your own future.

Ready to Plan Your Child’s Education Fund?

If you want:

✔ Personalized education corpus calculation

✔ Right SIP strategy

✔ Asset allocation guidance

✔ Annual portfolio review

Get expert guidance and start planning today.

Your child’s future deserves structured financial planning.