Should You Invest in Stocks or Mutual Funds? Beginner Guide with Risk Pyramid

February 5th, 2026 News

Should You Invest in Stocks or Mutual Funds? Beginner Comparison with Risk Pyramid Explained

When starting your investment journey, one question comes up again and again: Should You Invest in Stocks or Mutual Funds? For beginners, this decision can feel confusing and risky. This detailed guide explains Should You Invest in Stocks or Mutual Funds, compares both options, and uses a risk pyramid to help you choose the right investment path.

What Does “Should You Invest in Stocks or Mutual Funds” Really Mean for Beginners

The question Should You Invest in Stocks or Mutual Funds is not about choosing the best option for everyone, but about choosing what suits your risk appetite, knowledge, and goals. Beginners often struggle because both investments promise returns, but work very differently.

Understanding Stocks Before Deciding Should You Invest in Stocks or Mutual Funds

To answer Should You Invest in Stocks or Mutual Funds, you must first understand stocks. Stocks represent ownership in a company, and their prices fluctuate daily based on market conditions, company performance, and investor sentiment.

Understanding Mutual Funds to Answer Should You Invest in Stocks or Mutual Funds

When asking Should You Invest in Stocks or Mutual Funds, mutual funds offer a simpler alternative. Mutual funds pool money from many investors and invest across multiple stocks or assets, reducing individual risk.

Should You Invest in Stocks or Mutual Funds as a Beginner Investor

For beginners, Should You Invest in Stocks or Mutual Funds depends on experience. Stocks require research and monitoring, while mutual funds offer professional management, making them more beginner-friendly.

Risk and Return Comparison: Should You Invest in Stocks or Mutual Funds

One of the most important factors in Should You Invest in Stocks or Mutual Funds is risk. Stocks can give higher returns but carry higher volatility, while mutual funds balance risk and reward through diversification.

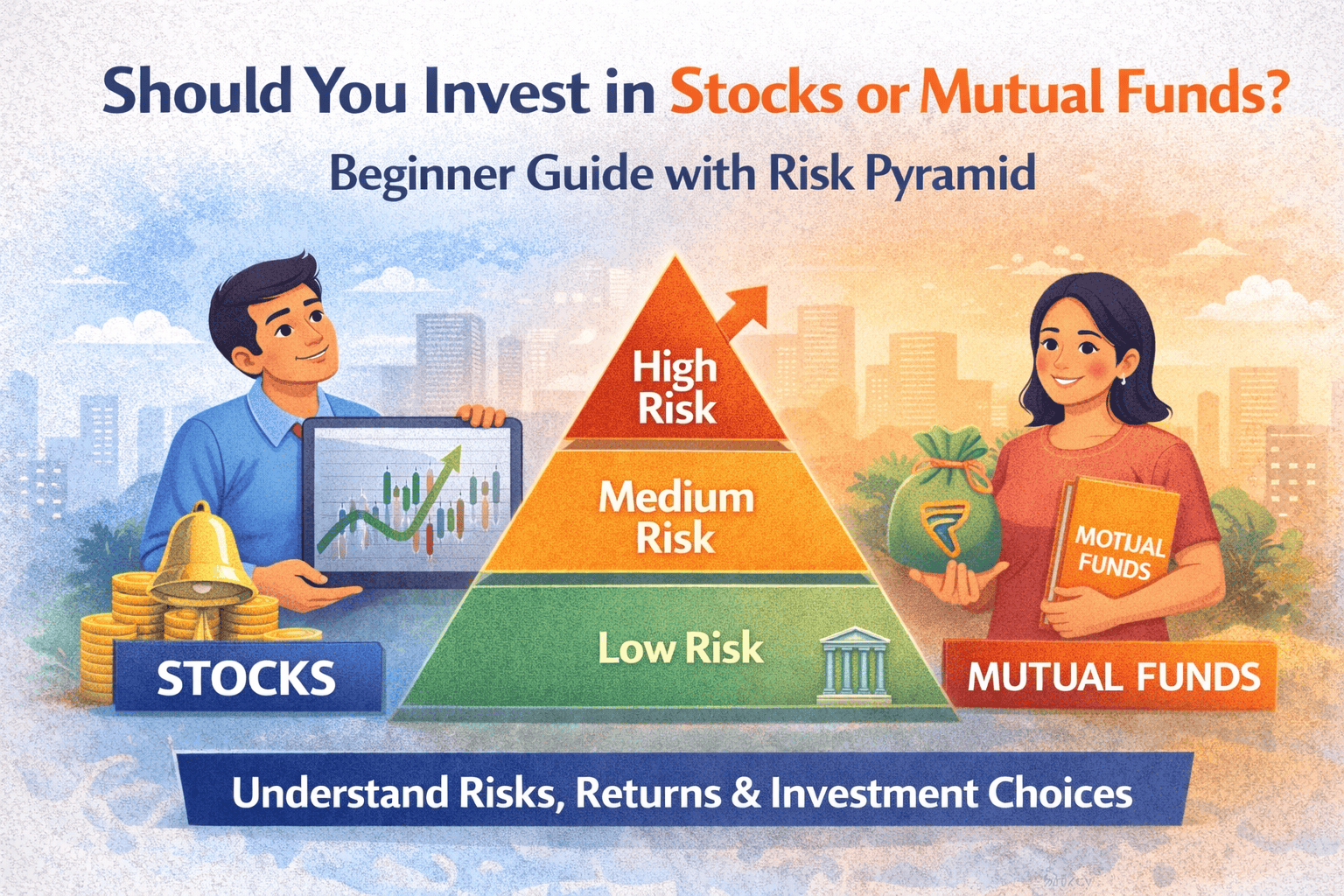

Risk Pyramid Explained to Decide Should You Invest in Stocks or Mutual Funds

The risk pyramid helps answer Should You Invest in Stocks or Mutual Funds by categorizing investments from low risk to high risk. Beginners usually start at the base with safer assets before moving upward.

Base of Risk Pyramid and Should You Invest in Stocks or Mutual Funds

At the base of the risk pyramid, safer investments dominate. When evaluating Should You Invest in Stocks or Mutual Funds, beginners usually prefer mutual funds here due to lower risk and diversification.

Middle of Risk Pyramid: Balanced View on Should You Invest in Stocks or Mutual Funds

The middle of the pyramid suits investors who understand markets moderately. Here, Should You Invest in Stocks or Mutual Funds becomes a mix—hybrid funds and selective stocks.

Top of Risk Pyramid and Should You Invest in Stocks or Mutual Funds

At the top, risk is highest. When asking Should You Invest in Stocks or Mutual Funds, direct stock trading suits only experienced investors who can handle volatility and losses.

Time Commitment Factor in Should You Invest in Stocks or Mutual Funds

Another key angle in Should You Invest in Stocks or Mutual Funds is time. Stocks need regular tracking, while mutual funds require minimal effort, making them ideal for busy professionals.

Knowledge Requirement for Should You Invest in Stocks or Mutual Funds

If you lack financial knowledge, Should You Invest in Stocks or Mutual Funds often favors mutual funds. Stock investing demands understanding financial statements, trends, and valuations.

Cost Comparison in Should You Invest in Stocks or Mutual Funds

Cost plays a role in Should You Invest in Stocks or Mutual Funds. Stocks involve brokerage fees, while mutual funds charge expense ratios, which are relatively low in index funds.

Emotional Discipline and Should You Invest in Stocks or Mutual Funds

Emotions affect returns heavily. When thinking Should You Invest in Stocks or Mutual Funds, remember that stocks trigger emotional decisions, whereas mutual funds encourage long-term discipline.

Diversification Advantage in Should You Invest in Stocks or Mutual Funds

Diversification is crucial in Should You Invest in Stocks or Mutual Funds. Mutual funds automatically diversify your investment, while stocks require large capital to diversify properly.

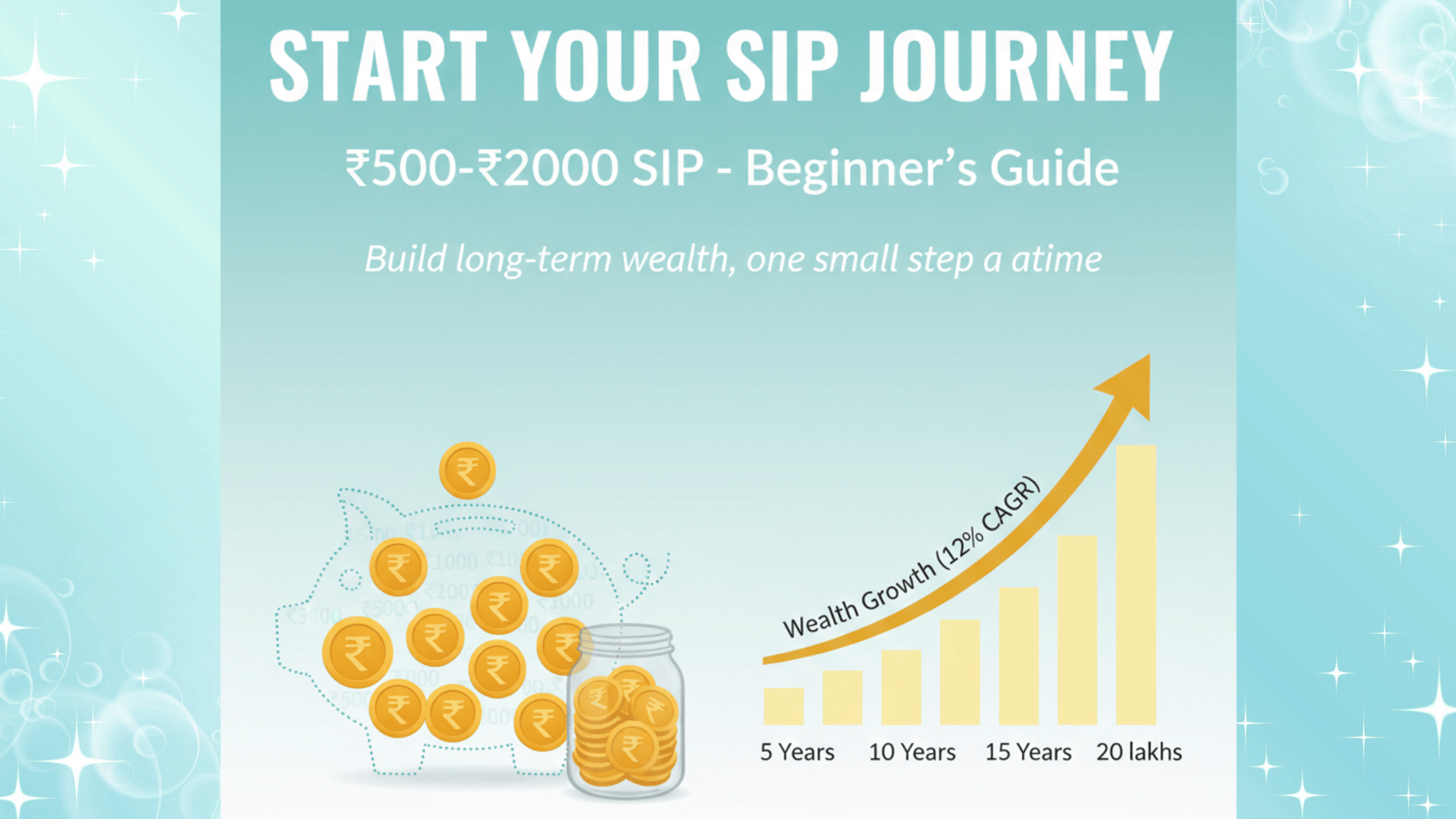

SIP Option and Should You Invest in Stocks or Mutual Funds

SIPs simplify investing. In the debate Should You Invest in Stocks or Mutual Funds, mutual funds win because SIPs allow disciplined monthly investing with low risk.

Taxation Aspect in Should You Invest in Stocks or Mutual Funds

Tax efficiency matters when answering Should You Invest in Stocks or Mutual Funds. Mutual funds like ELSS offer tax benefits, while stocks are taxed under capital gains rules.

Long-Term Wealth Creation and Should You Invest in Stocks or Mutual Funds

For long-term goals, Should You Invest in Stocks or Mutual Funds depends on patience. Mutual funds suit long-term wealth creation through compounding, especially for beginners.

Short-Term Goals and Should You Invest in Stocks or Mutual Funds

If your goal is short-term, Should You Invest in Stocks or Mutual Funds becomes tricky. Stocks are risky short-term, while debt or liquid mutual funds are safer.

Beginner Mistakes Related to Should You Invest in Stocks or Mutual Funds

Many beginners rush into stocks without knowledge. This makes Should You Invest in Stocks or Mutual Funds an important learning decision to avoid losses and frustration.

Real-Life Example Explaining Should You Invest in Stocks or Mutual Funds

A salaried individual investing through mutual funds via SIP understands Should You Invest in Stocks or Mutual Funds practically, as steady returns build wealth without stress.

When Stocks Make Sense in Should You Invest in Stocks or Mutual Funds

Stocks make sense in Should You Invest in Stocks or Mutual Funds only when you have knowledge, time, and emotional control to manage market fluctuations.

When Mutual Funds Are Better in Should You Invest in Stocks or Mutual Funds

For most beginners, Should You Invest in Stocks or Mutual Funds leans strongly toward mutual funds due to safety, diversification, and professional management.

Hybrid Approach to Should You Invest in Stocks or Mutual Funds

A balanced solution to Should You Invest in Stocks or Mutual Funds is combining both—mutual funds for stability and stocks for higher growth once experience increases.

Common Myths Around Should You Invest in Stocks or Mutual Funds

Many believe stocks always outperform. In reality, Should You Invest in Stocks or Mutual Funds depends on consistency and discipline, not hype.

How Financial Advisors Help Decide Should You Invest in Stocks or Mutual Funds

Professional advice clarifies Should You Invest in Stocks or Mutual Funds based on risk profile, goals, and income stability.

Risk Management Strategy for Should You Invest in Stocks or Mutual Funds

Risk management is central to Should You Invest in Stocks or Mutual Funds, and the risk pyramid helps investors allocate money wisely across risk levels.

Final Verdict on Should You Invest in Stocks or Mutual Funds

The final answer to Should You Invest in Stocks or Mutual Funds is simple: beginners should start with mutual funds and slowly explore stocks as knowledge and confidence grow.

Conclusion: Should You Invest in Stocks or Mutual Funds for Long-Term Success

In conclusion, Should You Invest in Stocks or Mutual Funds depends on your risk tolerance, time, and experience. For beginners, mutual funds offer a safer, smarter, and stress-free way to begin investing and build long-term wealth.