Retirement Planning in Your 30s – Smart Investment & Wealth Building Guide for Indian Salaried Professionals

February 13th, 2026 News

Retirement Planning in Your 30s – Complete Guide

Most people in their 30s are focused on:

-

Career growth

-

Buying a home

-

Marriage & children

-

Lifestyle upgrades

Retirement?

“Abhi toh bahut time hai…”

But here’s the truth:

👉 Your 30s are the BEST time to start retirement planning.

If you delay by even 5–10 years, the cost of retirement doubles.

This complete guide will show you how to plan retirement smartly in your 30s in India.

Why Retirement Planning in Your 30s Is So Powerful

Because of one word:

Compounding.

Example:

If you invest ₹10,000 per month from age 30 to 60

At 12% average return

You can build approx ₹3.5–4 crore corpus.

But if you start at 40?

You’ll need almost double monthly investment to reach the same goal.

That’s the power of starting early.

Step 1: Decide Your Retirement Age

Most Indians assume 60.

But ask yourself:

-

Do you want to work till 60?

-

Or achieve financial freedom by 50–55?

Earlier retirement = Higher monthly investment required.

Step 2: Estimate Future Monthly Expenses

Let’s say your current monthly expense is ₹50,000.

Assuming 6% inflation for 25 years:

At age 60, that ₹50,000 becomes approx ₹2.15 lakh per month.

Inflation silently reduces purchasing power.

That’s why retirement planning in your 30s must consider inflation.

Step 3: Calculate Required Retirement Corpus

Rule of thumb:

You need 20–25 times your annual expenses.

If future annual expense = ₹25 lakh

Required corpus = ₹5–6 crore

This ensures:

✔ Regular income

✔ Inflation protection

✔ Medical security

✔ Peace of mind

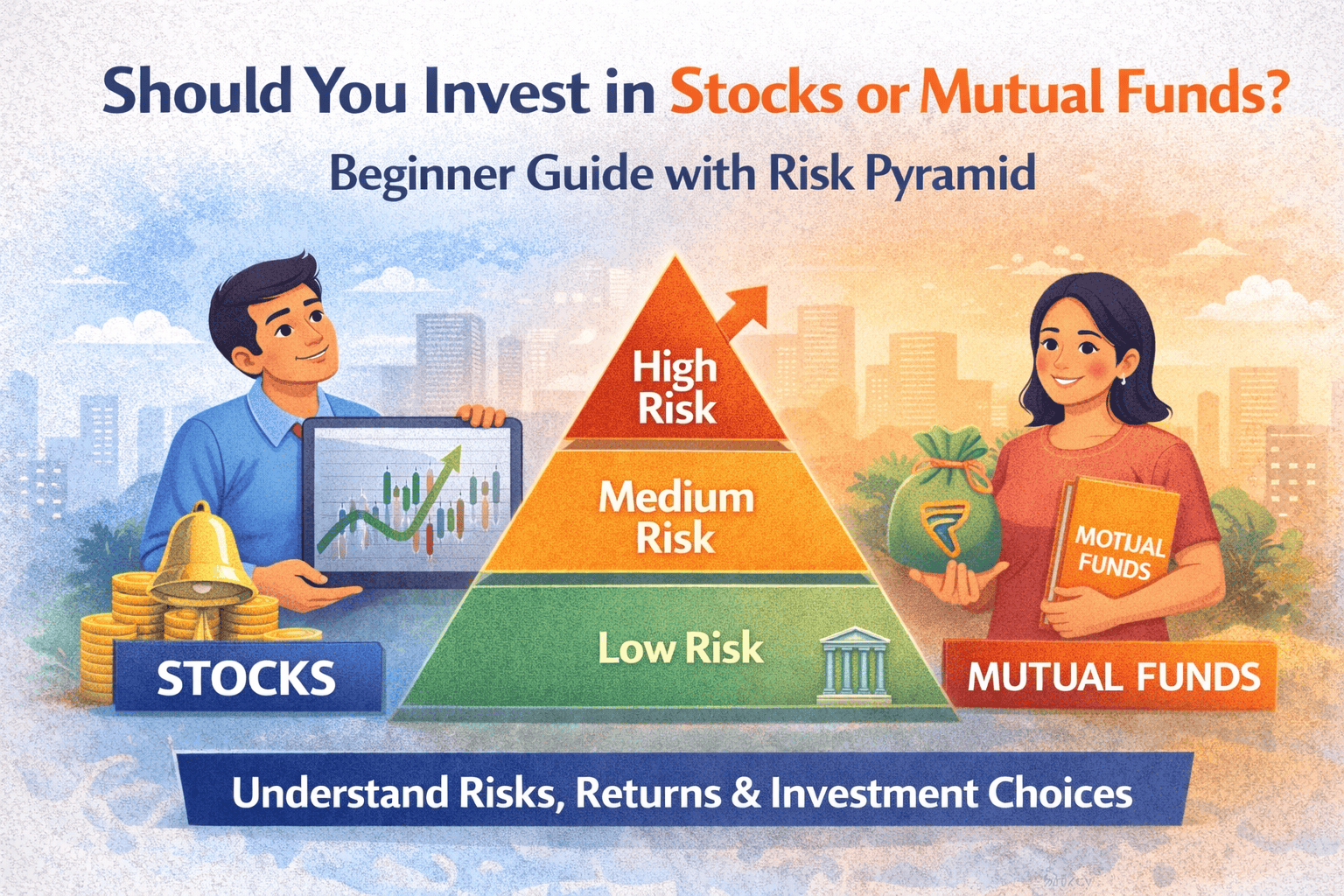

Step 4: Where Should You Invest in Your 30s?

Since retirement is long-term (20–30 years away), equity exposure should be higher.

Ideal allocation:

-

60–70% Equity Mutual Funds

-

20% Debt Funds

-

10% Gold / Diversification

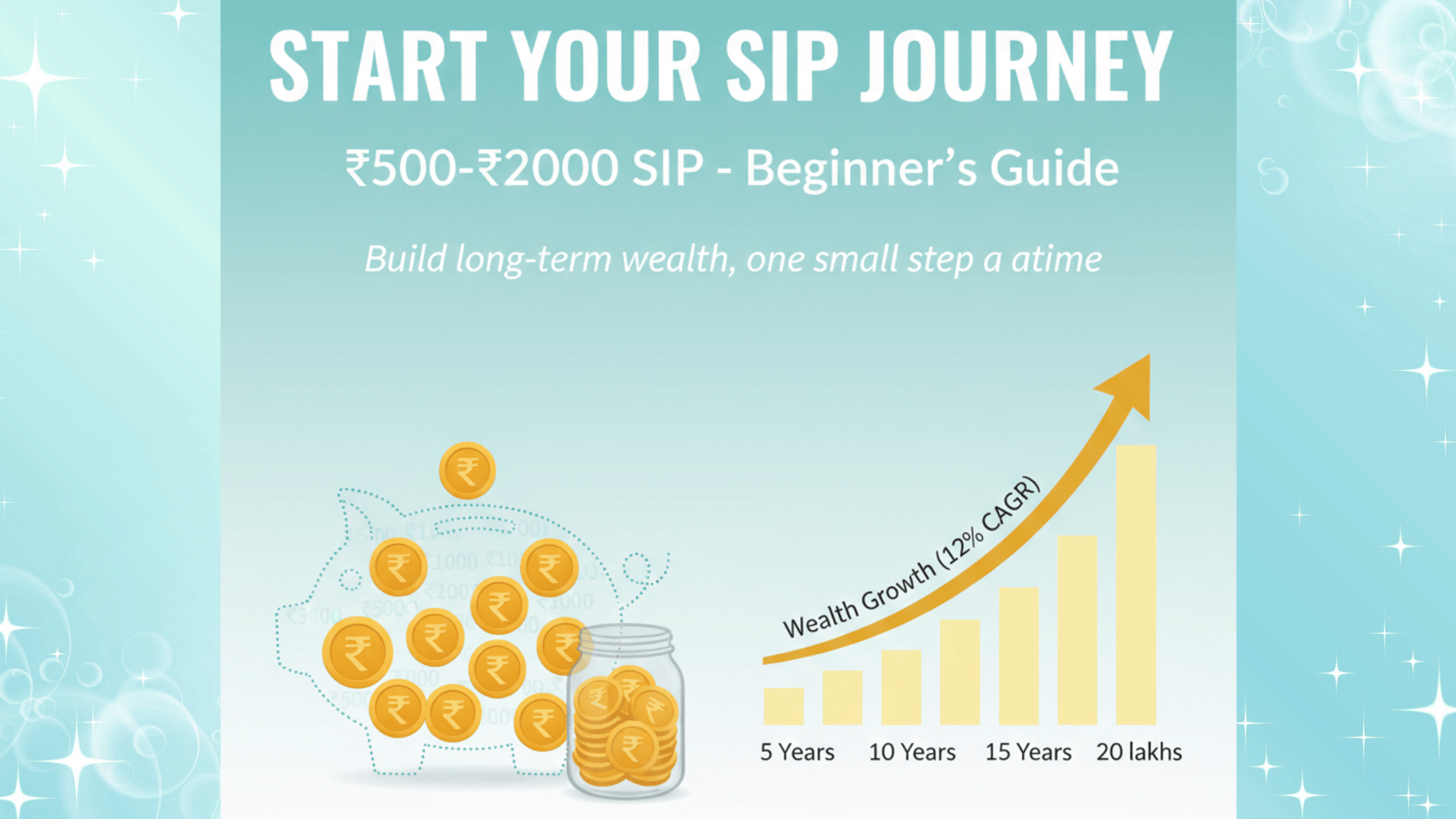

SIP in equity mutual funds becomes the backbone of retirement planning in your 30s.

Step 5: Increase SIP Every Year

Salary increases every year.

Your investments should too.

Follow the 10% step-up rule:

If SIP = ₹15,000 today

Increase by 10% every year.

This dramatically improves retirement corpus.

Step 6: Build Emergency Fund First

Before aggressive retirement investing:

👉 Maintain 6–9 months of expenses in emergency fund.

Without this, one job loss can disrupt long-term planning.

Step 7: Don’t Ignore Insurance

Retirement planning in your 30s must include:

✔ Term Insurance (10–15x income)

✔ Health Insurance (Family floater)

One medical emergency can wipe out investments.

Insurance protects your retirement plan.

Real Example: Retirement Planning in Your 30s

Age: 32

Monthly SIP: ₹20,000

Return: 12%

Time: 28 years

Potential corpus ≈ ₹4–5 crore

This shows retirement planning in your 30s is not impossible — it’s mathematical.

Common Mistakes People Make in Their 30s

❌ Only investing in PPF

❌ Buying too many insurance policies

❌ Stopping SIP during market crash

❌ Ignoring inflation

❌ Delaying start

Avoiding these mistakes increases retirement success rate.

Should You Rely Only on EPF?

EPF is helpful.

But usually not enough.

Why?

-

Limited return

-

Inflation impact

-

No growth flexibility

Retirement planning in your 30s should include diversified investments.

How Much Should You Invest for Retirement in Your 30s?

General rule:

Invest minimum 20–30% of income.

If income ₹1 lakh per month

Retirement investment should be ₹20,000–30,000.

Earlier start = Lower burden later.

How Wealthifyme Helps in Retirement Planning in Your 30s

At Wealthifyme, we help salaried professionals:

✔ Calculate retirement corpus

✔ Design goal-based SIP strategy

✔ Balance equity & debt

✔ Review portfolio annually

✔ Adjust plan as income grows

Retirement planning is not random investing.

It requires strategy.

FAQs – Retirement Planning in Your 30s

1. Is 30 too early to plan retirement?

No. It’s ideal.

2. How much corpus is enough?

Depends on lifestyle & inflation.

3. Can I retire at 50?

Yes, with aggressive and disciplined investing.

4. Is SIP enough for retirement?

Yes, if started early and increased regularly.

Final Thoughts

Retirement planning in your 30s gives you:

✔ Time advantage

✔ Lower stress

✔ Smaller monthly burden

✔ Bigger wealth

The earlier you start, the easier it becomes.

Don’t wait for “right time.”

The right time is your 30s.

🚀 Ready to Start Your Retirement Plan?

If you’re in your 30s and serious about financial freedom:

👉 Get a personalized retirement roadmap

👉 Calculate your required corpus

👉 Start goal-based SIP

Book a consultation with Wealthifyme today.