Best SIP Investment Plans in India for Beginners in 2026 Guide

February 19th, 2026 News

Best SIP Plans in India 2026 – Complete Guide for Beginners

Introduction

SIP (Systematic Investment Plan) has become one of the most popular investment methods in India. With increasing financial awareness and easier access to mutual funds through digital platforms, more Indians are choosing SIP as their preferred route for long-term wealth creation.

But the real question is:

Which are the best SIP plans in India 2026?

And how should a beginner choose the right one?

In this complete mutual fund SIP guide, we will cover:

-

What SIP is and how it works

-

Why SIP is ideal for beginners

-

Best SIP plan categories for 2026

-

Expected SIP returns in India

-

How much you should invest

-

Common mistakes to avoid

Let’s begin.

What is SIP & How Does It Work?

A Systematic Investment Plan (SIP) is a method of investing a fixed amount regularly (usually monthly) in a mutual fund scheme.

Instead of investing ₹1,20,000 at once, you invest ₹10,000 every month.

How SIP Works:

-

You select a mutual fund.

-

You choose a fixed amount.

-

The amount gets automatically deducted monthly.

-

You receive units based on the NAV (Net Asset Value).

-

Over time, compounding grows your investment.

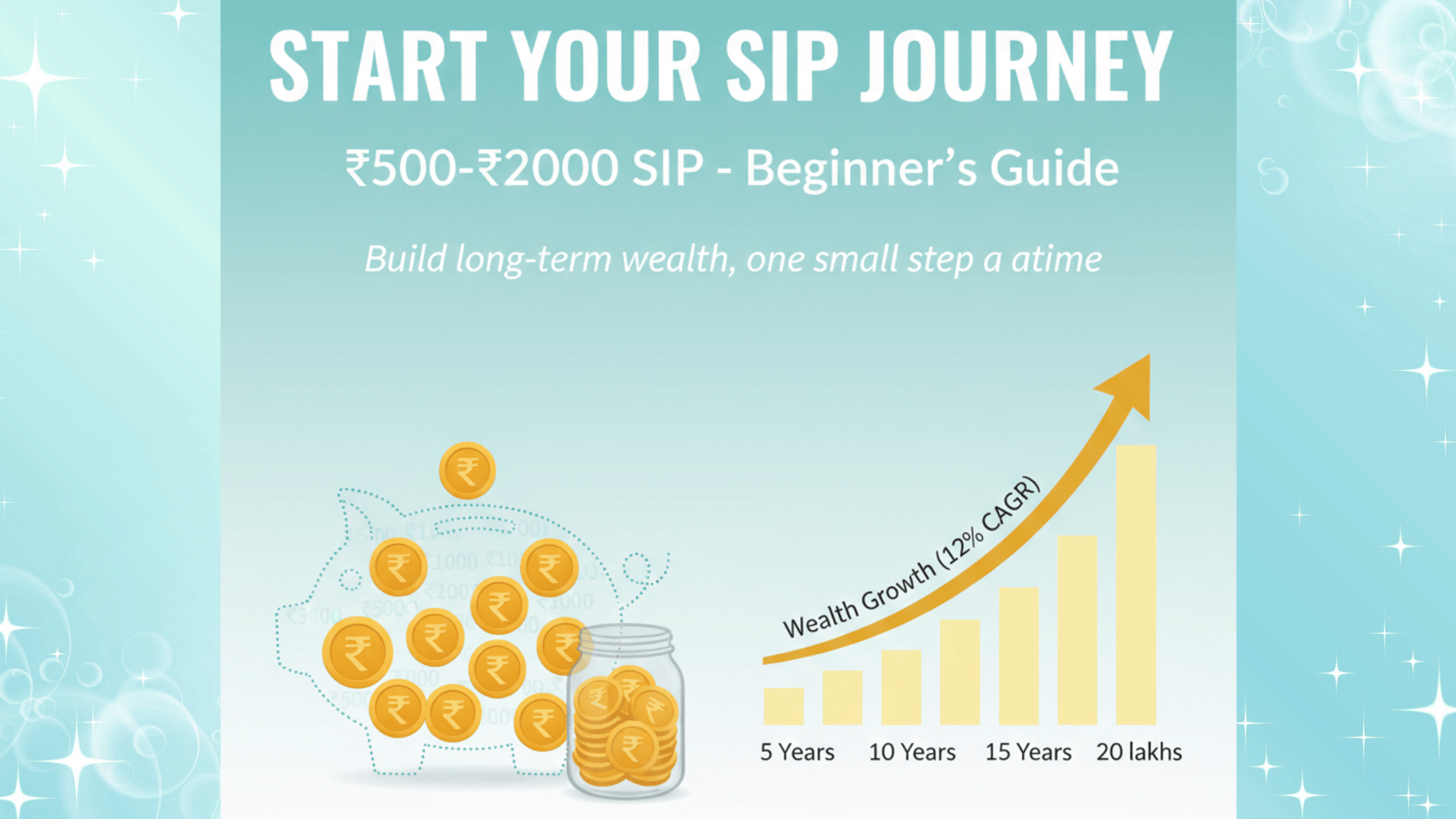

Power of Compounding

Compounding means earning returns on your returns.

Example:

If you invest ₹10,000 per month for 20 years at 12% average return:

Total Investment: ₹24,00,000

Estimated Corpus: ₹99,91,479 (Approx ₹1 Crore)

This is why SIP for beginners is considered one of the safest ways to start investing.

Rupee Cost Averaging

Markets go up and down.

With SIP:

-

When market falls → you buy more units

-

When market rises → you buy fewer units

Over time, your average cost reduces.

This reduces risk compared to lump sum investing.

Why SIP is Ideal for Beginners

If you are new to investing, SIP is the smartest starting point.

Here’s why:

1. Low Entry Barrier

You can start SIP with just ₹500 per month.

2. Disciplined Investing

Automatic deduction builds financial discipline.

3. No Need to Time the Market

Market timing is risky. SIP averages your cost.

4. Long-Term Wealth Creation

SIP works best for:

-

Retirement planning

-

Child education planning

-

Wealth accumulation

-

Financial independence

Best SIP Plans in India 2026 (By Category)

Instead of randomly selecting a fund, you should choose based on category and financial goal.

Below are the top SIP fund categories for 2026:

1. Large Cap Funds

Suitable For:

-

Conservative investors

-

Beginners

-

Long-term stability

Why Choose?

Large cap funds invest in top 100 companies in India.

Expected Returns: 10–12% long term

Risk Level: Moderate

Good for stable growth.

2. Flexi Cap Funds

Suitable For:

-

Investors wanting balanced growth

-

Medium to long-term goals

These funds invest in large, mid, and small cap stocks.

Expected Returns: 12–14%

Risk Level: Moderate to High

Flexibility allows fund manager to adjust strategy.

3. Index Funds

Suitable For:

-

Low-cost investing

-

Passive investors

-

Long-term wealth builders

Index funds track Nifty 50 or Sensex.

Advantages:

-

Low expense ratio

-

Transparent strategy

-

No fund manager bias

Expected Returns: 11–13% long term

Many experts consider index funds among the top SIP funds 2026 for disciplined investors.

4. ELSS (Tax Saving Funds)

Suitable For:

-

Investors with 3+ year horizon

Lock-in: 3 years

Potential Returns: 12–15%

Better than traditional tax-saving options like PPF if risk appetite allows.

5. Hybrid Funds

Suitable For:

-

Low risk investors

-

Retirement-focused individuals

Hybrid funds invest in equity + debt.

Expected Returns: 8–11%

Risk Level: Lower than pure equity

How to Choose the Best SIP Plan in 2026

Don’t choose based on “highest past return”.

Instead, follow this checklist:

✔ Define Your Goal

-

Retirement

-

House purchase

-

Wealth creation

✔ Decide Time Horizon

-

Less than 3 years → Avoid equity SIP

-

5+ years → Equity SIP suitable

-

10+ years → Strong compounding advantage

✔ Check Expense Ratio

Lower expense ratio means higher take-home returns.

✔ Check Fund Consistency

Look at:

-

5-year performance

-

Downside protection

-

Fund manager track record

SIP Returns in India – What Can You Expect?

One of the most searched queries is: “SIP returns India”.

Let’s set realistic expectations.

| Fund Type | Expected Long-Term Returns |

|---|---|

| Large Cap | 10–12% |

| Flexi Cap | 12–14% |

| Mid Cap | 13–16% |

| Index Fund | 11–13% |

| Hybrid | 8–11% |

⚠ Note: These are long-term averages, not guaranteed returns.

Markets fluctuate yearly.

How Much Should You Invest in SIP?

Let’s calculate using a simple example.

Scenario 1:

Goal: ₹1 Crore

Time: 20 Years

Return: 12%

Required SIP ≈ ₹10,000 per month

Scenario 2:

Goal: ₹3 Crore (Retirement)

Time: 25 Years

Return: 12%

Required SIP ≈ ₹18,000–₹22,000 per month

Smart Strategy: Increase SIP Every Year

If you increase SIP by 10% annually (Step-Up SIP), your corpus grows much faster.

Example:

Start: ₹10,000/month

Increase 10% yearly

You may reach ₹1.5–2 Crore instead of ₹1 Crore.

Common SIP Mistakes to Avoid in 2026

Avoid these if you want strong results.

❌ 1. Stopping SIP During Market Crash

Market fall is the best time for SIP.

❌ 2. Choosing Based Only on Past Returns

Past returns don’t guarantee future performance.

❌ 3. Investing Without Goal

Random investing leads to random results.

❌ 4. Not Reviewing Portfolio

Review annually, but don’t panic monthly.

❌ 5. Not Increasing SIP

Income increases every year — SIP should too.

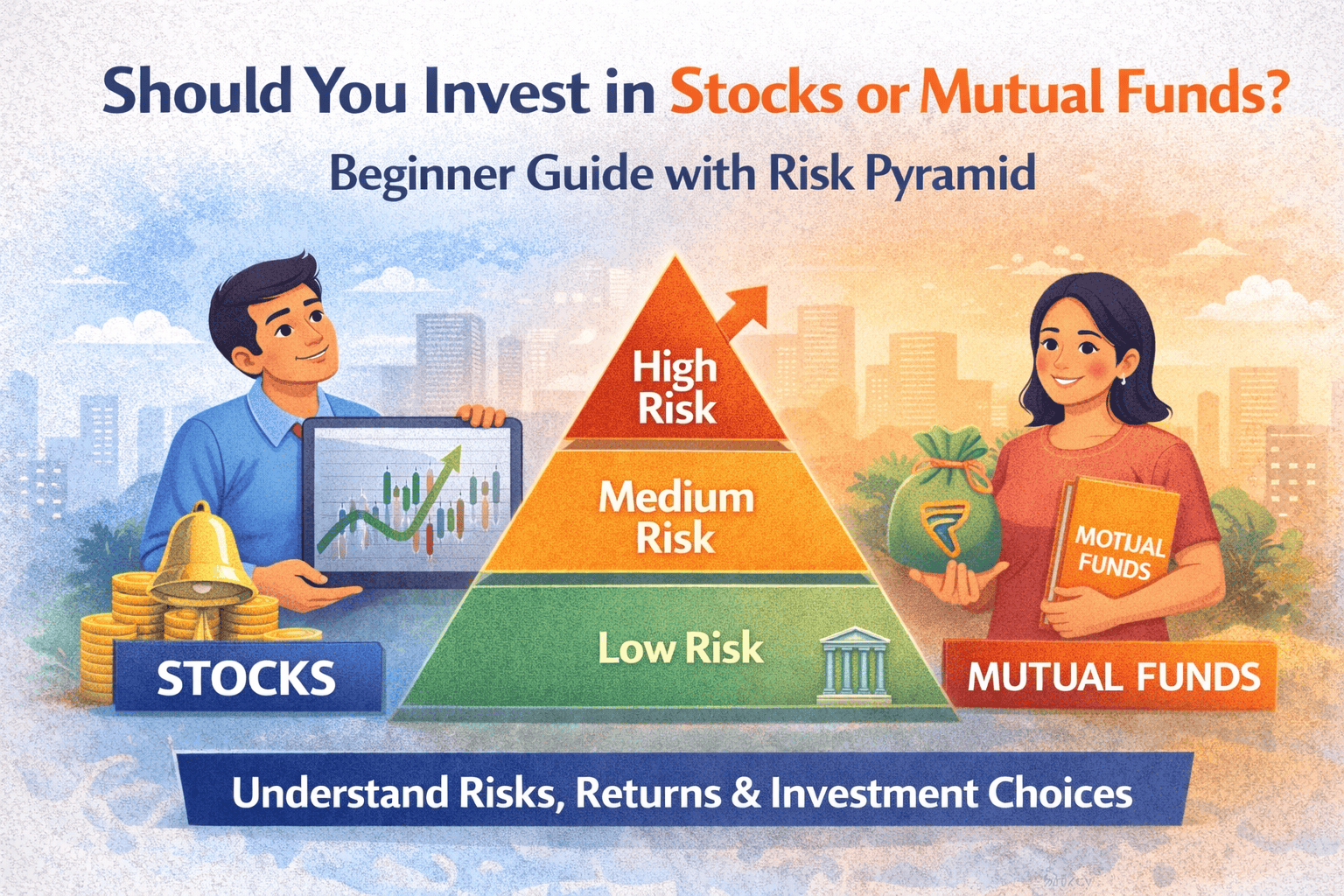

SIP vs Lump Sum – Which is Better?

| SIP | Lump Sum |

|---|---|

| Lower Risk | Higher Risk |

| Suitable for Salaried | Suitable for surplus funds |

| Market timing not required | Requires timing |

| Builds discipline | One-time decision |

For beginners, SIP is generally safer.

Who Should Start SIP in 2026?

You should start SIP if:

-

You are salaried

-

You are in your 20s or 30s

-

You want tax saving

-

You want long-term wealth

The earlier you start, the less you need to invest.

Example: Power of Starting Early

Person A starts at 25

Invests ₹8,000/month for 25 years

Return 12%

Corpus ≈ ₹1.3 Crore

Person B starts at 35

Invests ₹8,000/month for 15 years

Corpus ≈ ₹40–45 Lakhs

10-year delay = huge loss.

Final Thoughts: Best SIP Plans in India 2026

There is no “one best SIP plan”.

The best SIP plan is the one that:

✔ Matches your financial goals

✔ Aligns with your risk appetite

✔ Has long-term consistency

✔ Fits your time horizon

SIP is not a shortcut.

It is a disciplined, long-term wealth strategy.

If you are serious about financial independence, retirement security, or wealth building, SIP should be part of your financial plan in 2026.

Ready to Start?

If you want a personalized SIP strategy tailored to your income, goals, and risk profile, consider consulting a financial planning expert.

👉 Start your investment journey with Wealthifyme today.