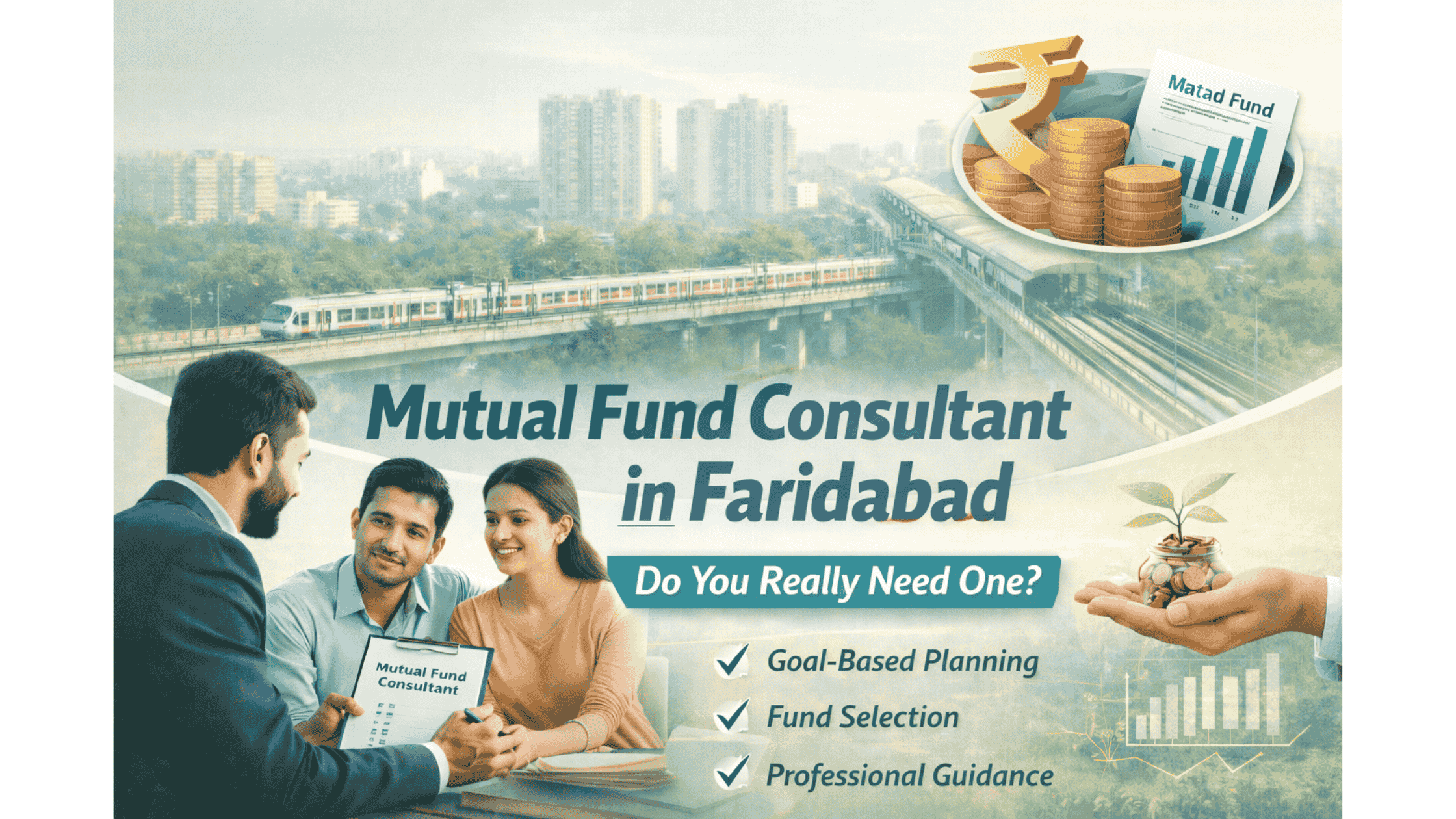

Mutual Fund Consultant in Faridabad: Do You Really Need One?

February 11th, 2026 News

Mutual Fund Consultant in Faridabad: Do You Really Need One?

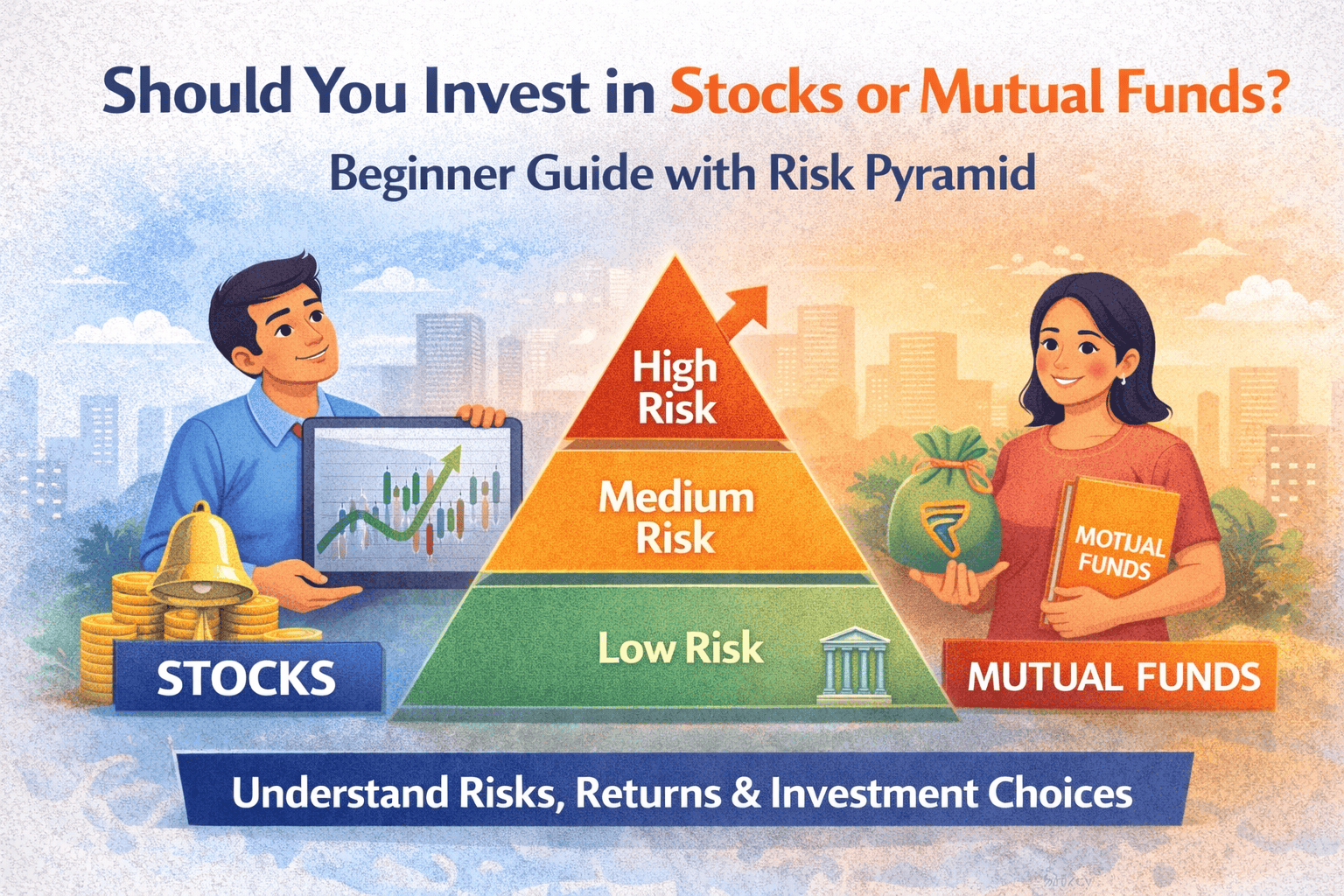

Investing in mutual funds has become one of the most popular ways to build wealth in India. But when it comes to selecting the right scheme, understanding risk, and aligning investments with long-term goals, many investors feel confused.

This is where a Mutual Fund Consultant in Faridabad can make a big difference.

If you are wondering whether you really need a professional advisor or can manage everything on your own, this complete guide will help you decide.

Why Mutual Funds Are Popular in India

Mutual funds allow investors to pool money and invest in stocks, bonds, and other securities under professional management. They offer:

-

Diversification

-

Professional management

-

Systematic Investment Plans (SIP)

-

Flexibility in investment

-

Long-term wealth creation

But despite these advantages, choosing the right fund is not as simple as it looks.

The Real Problem: Too Many Choices

Today, there are:

-

1000+ mutual fund schemes

-

Different categories (Equity, Debt, Hybrid, ELSS, Index Funds)

-

Multiple fund houses

-

Varying risk levels

Without proper understanding, investors often:

-

Select funds based on past returns

-

Stop SIPs during market corrections

-

Invest without goal planning

-

Overlap similar funds

-

Ignore asset allocation

This is exactly where a Mutual Fund Consultant in Faridabad provides structured guidance.

What Does a Mutual Fund Consultant in Faridabad Actually Do?

A professional consultant does much more than just “suggest funds.”

Here’s what you should expect:

1️⃣ Risk Profiling

Understanding your income, expenses, goals, and risk tolerance.

2️⃣ Goal-Based Planning

Planning SIPs for:

-

Retirement

-

Child education

-

Home purchase

-

Wealth creation

3️⃣ Fund Selection

Choosing funds based on:

-

Performance consistency

-

Expense ratio

-

Fund manager track record

-

Portfolio quality

4️⃣ Portfolio Review

Regular monitoring and rebalancing.

5️⃣ Emotional Discipline

Helping you stay invested during market volatility.

At Wealthifyme, we focus on goal-based planning instead of random fund selection.

Can You Invest Without a Mutual Fund Consultant?

Yes, technically you can.

But here are common mistakes DIY investors make:

-

Investing in trending funds

-

Selecting 8–10 funds without strategy

-

No asset allocation

-

Panic selling during market crashes

-

Ignoring tax efficiency

A professional Mutual Fund Consultant in Faridabad ensures structure, discipline, and strategy.

Benefits of Hiring a Mutual Fund Consultant in Faridabad

✔ Local Understanding

A local advisor understands:

-

Salaried professionals in Faridabad

-

Business owners’ cash flow patterns

-

Real estate vs equity mindset

✔ Face-to-Face Consultation

Personal meetings build trust.

✔ Personalized Strategy

No copy-paste portfolio.

✔ Ongoing Support

Market updates and portfolio review.

✔ Time Saving

You focus on career/business while your investments are managed strategically.

Why Local SEO Matters for Investors

When someone searches:

“Mutual Fund Consultant in Faridabad”

They are not searching for information.

They are looking for help.

This is high-intent traffic — meaning higher chances of enquiry.

That is why choosing a Mutual Fund Consultant in Faridabad with a professional website and verified presence matters.

You can also verify registered mutual fund distributors through AMFI’s official website:

How to Choose the Right Mutual Fund Consultant in Faridabad

Before finalizing, check:

1️⃣ Registration & Compliance

Is the consultant properly registered?

2️⃣ Transparency

Are charges clearly explained?

3️⃣ Goal-Based Approach

Do they ask about goals first?

4️⃣ Review Process

How often will your portfolio be reviewed?

5️⃣ Client Communication

Do they provide regular updates?

At Wealthifyme, we provide clear disclosures and structured planning.

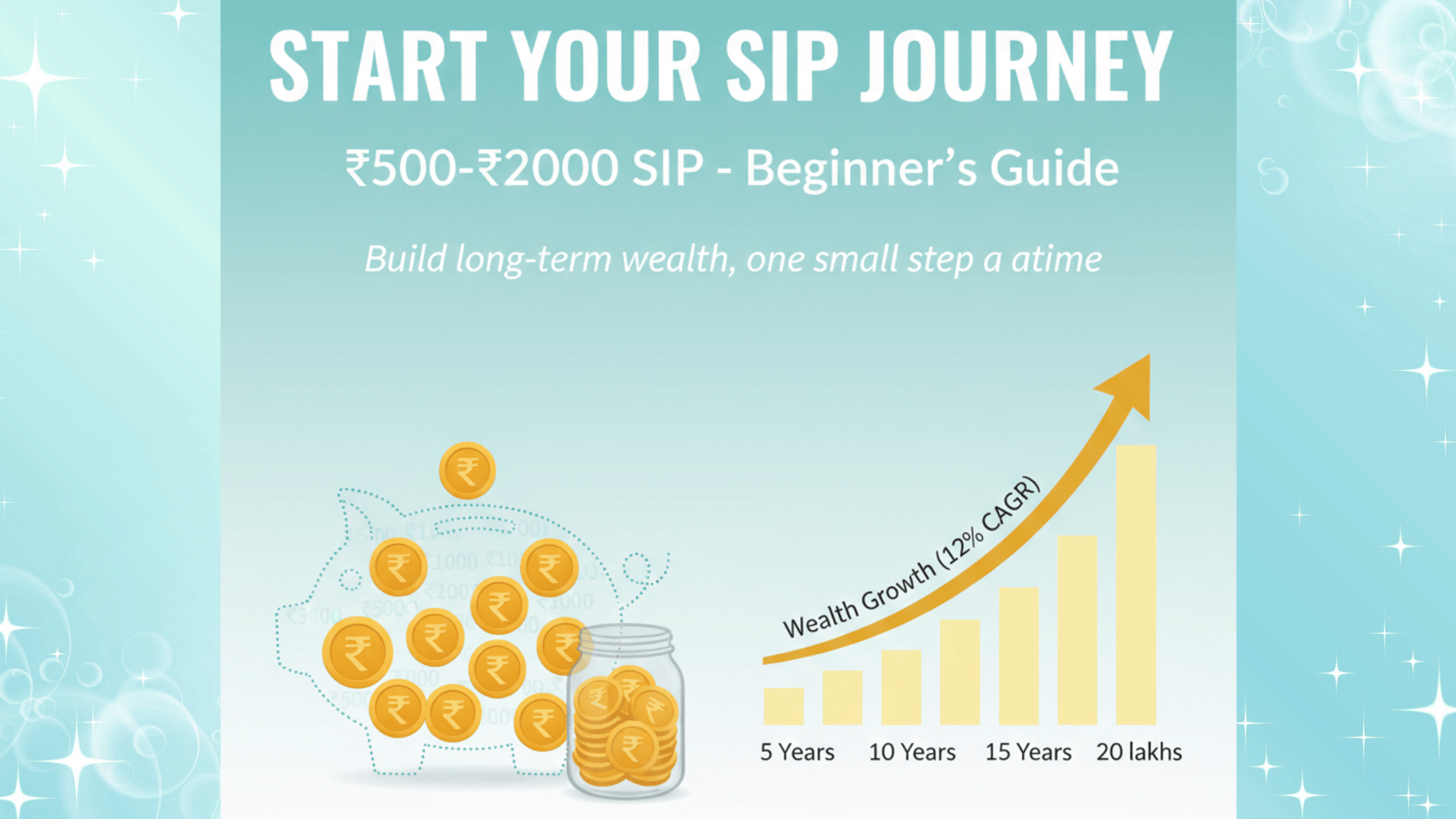

SIP Planning with a Mutual Fund Consultant in Faridabad

Let’s understand with an example:

If you invest ₹10,000 monthly in SIP

At 12% average annual return

For 20 years

You can potentially build a corpus of ₹1 crore+.

(You can calculate SIP growth using SEBI’s investor education resources)

But selecting the right fund and staying invested is key.

This is where a Mutual Fund Consultant in Faridabad ensures consistency.

Common Myths About Mutual Fund Consultants

❌ Myth 1: Advisors are expensive

Reality: Proper planning often improves returns and reduces mistakes.

❌ Myth 2: I only need advice if I am rich

Reality: Early planning creates wealth.

❌ Myth 3: Online apps are enough

Reality: Apps provide execution, not strategy.

Why Choose Wealthifyme as Your Mutual Fund Consultant in Faridabad?

At Wealthifyme, our approach is simple:

-

Goal-based financial planning

-

SIP strategy customization

-

Risk-balanced portfolios

-

Regular review & rebalancing

-

Clear communication

We focus on guidance, not product pushing.

You can also explore our detailed guide on

👉 How to Start SIP in Faridabad – Step-by-Step Beginner Guide

And if you're new to investing, read:

👉 SIP Kya Hota Hai? Beginner Guide to SIP Investment in India

These resources help you understand the basics before consultation.

Do You Really Need a Mutual Fund Consultant in Faridabad?

If you relate to any of these:

-

Confused between fund options

-

Unsure how much to invest

-

No clear financial goals

-

Want structured wealth creation

-

Need tax-efficient investment

Then yes — a Mutual Fund Consultant in Faridabad can significantly improve your financial journey.

When You Might Not Need One

You may not need a consultant if:

-

You are financially literate

-

You understand asset allocation

-

You actively monitor investments

-

You manage risk discipline yourself

But most investors benefit from professional guidance.

The Bottom Line

Mutual funds are powerful wealth-building tools — but only when used strategically.

A professional Mutual Fund Consultant in Faridabad ensures:

-

Discipline

-

Structure

-

Risk management

-

Goal alignment

-

Long-term growth

Instead of randomly investing, structured planning gives clarity and confidence.

🚀 Book Your Consultation with Wealthifyme

If you are looking for a trusted Mutual Fund Consultant in Faridabad, WealthifyMe is here to guide you.

✔ Personalized SIP Planning

✔ Goal-Based Investment Strategy

✔ Transparent Advisory

✔ Regular Portfolio Review

📞 Book Your Free Consultation Today

📍 Serving Faridabad Investors

🌐 Visit: www.wealthifyme.co.in

Start investing with clarity, not confusion.