Monthly Budget Planning Formula for Indian Salaried People (Simple & Practical Guide)

February 12th, 2026 News

Monthly Budget Planning Formula for Indian Salaried People (Complete Practical Guide)

Introduction: Why Monthly Budget Planning Formula for Indian Salaried People Is Important

Monthly Budget Planning Formula for Indian Salaried People is not just about tracking expenses — it is about controlling your financial future. Most salaried individuals in India earn a fixed income every month, but still struggle with savings.

The problem is not income.

The problem is lack of a clear Monthly Budget Planning Formula for Indian Salaried People.

If you are earning ₹25,000 or ₹1,50,000 per month, the same principle applies. Without a proper budgeting system, money disappears.

In this guide, you will learn a simple, practical, and easy-to-follow Monthly Budget Planning Formula for Indian Salaried People that actually works.

What Is a Monthly Budget Planning Formula for Indian Salaried People?

The Monthly Budget Planning Formula for Indian Salaried People is a structured way to divide your salary into specific categories:

-

Needs

-

Investments

-

Emergency savings

-

Lifestyle expenses

-

Insurance

Instead of spending first and saving later, this formula helps you:

👉 Save first

👉 Invest systematically

👉 Spend guilt-free

This is how financially disciplined people manage money.

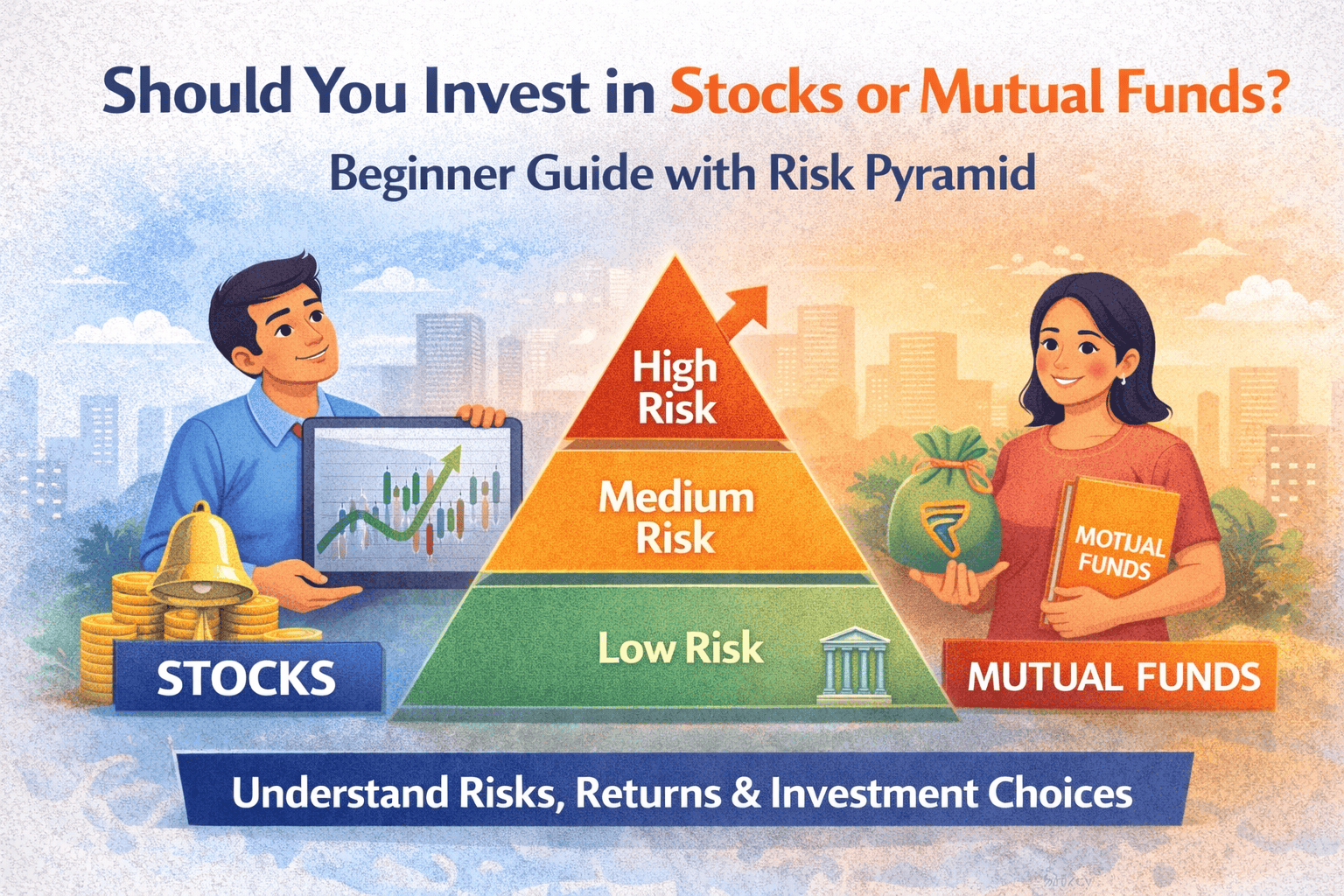

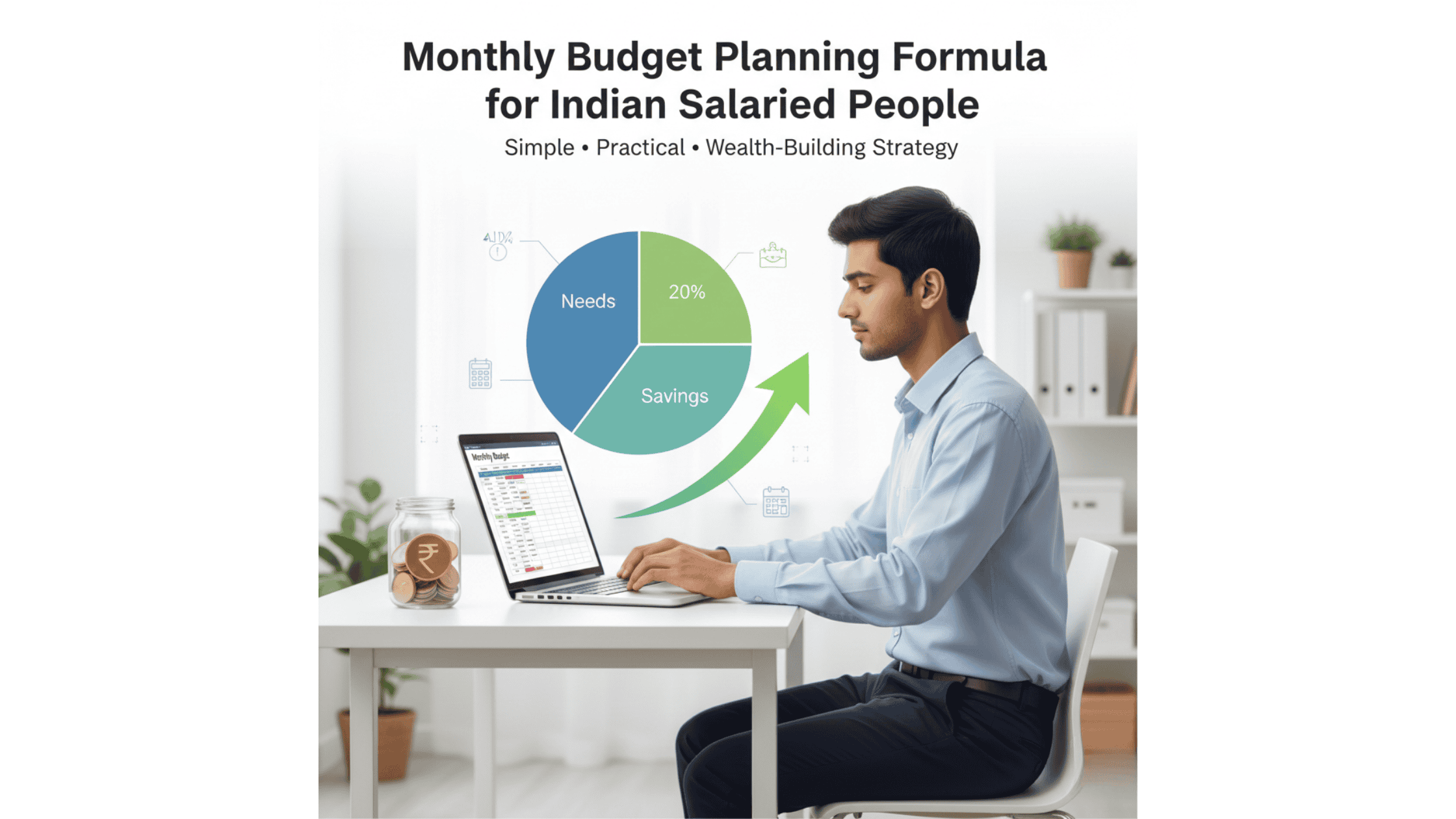

The 50-30-20 Rule: Basic Monthly Budget Planning Formula for Indian Salaried People

One of the most popular versions of Monthly Budget Planning Formula for Indian Salaried People is the 50-30-20 rule.

50% – Needs

-

Rent / Home EMI

-

Groceries

-

Electricity & bills

-

School fees

-

Transportation

30% – Lifestyle

-

Eating out

-

Shopping

-

OTT subscriptions

-

Travel

20% – Savings & Investments

-

SIP

-

PPF

-

Emergency fund

-

Insurance premium

But in India, this formula needs slight modification.

Indian Version: Smart Monthly Budget Planning Formula for Indian Salaried People

Because Indian families often have responsibilities like parents, EMIs, and dependents, a more practical version is:

40% – Fixed Expenses

20% – Financial Security (Insurance + Emergency)

20% – Investments (SIP, Long-Term Wealth)

10% – Short-Term Goals

10% – Lifestyle

This modified Monthly Budget Planning Formula for Indian Salaried People ensures both security and growth.

Real Example: Monthly Budget Planning Formula for Indian Salaried People (₹50,000 Salary)

Let’s understand with a practical example.

Monthly Salary = ₹50,000

| Category | Percentage | Amount |

|---|---|---|

| Fixed Expenses | 40% | ₹20,000 |

| Insurance + Emergency | 20% | ₹10,000 |

| Investments (SIP etc.) | 20% | ₹10,000 |

| Short-Term Goals | 10% | ₹5,000 |

| Lifestyle | 10% | ₹5,000 |

This Monthly Budget Planning Formula for Indian Salaried People ensures:

✔ No financial stress

✔ Growing investments

✔ Emergency readiness

Step-by-Step Monthly Budget Planning Formula for Indian Salaried People

Step 1: Calculate Net Income

Always budget from in-hand salary, not CTC.

Step 2: List Fixed Expenses

Rent, EMI, bills, groceries.

Step 3: Automate Investments

Start SIP immediately after salary credit.

Step 4: Build Emergency Fund

Minimum 6 months of expenses.

Step 5: Track Spending

Use Excel, Google Sheets, or apps.

Following this Monthly Budget Planning Formula for Indian Salaried People removes financial confusion.

Common Mistakes in Monthly Budget Planning Formula for Indian Salaried People

❌ Saving whatever is left

❌ No emergency fund

❌ Too many EMIs

❌ Ignoring insurance

❌ No goal-based planning

Avoiding these mistakes strengthens your Monthly Budget Planning Formula for Indian Salaried People.

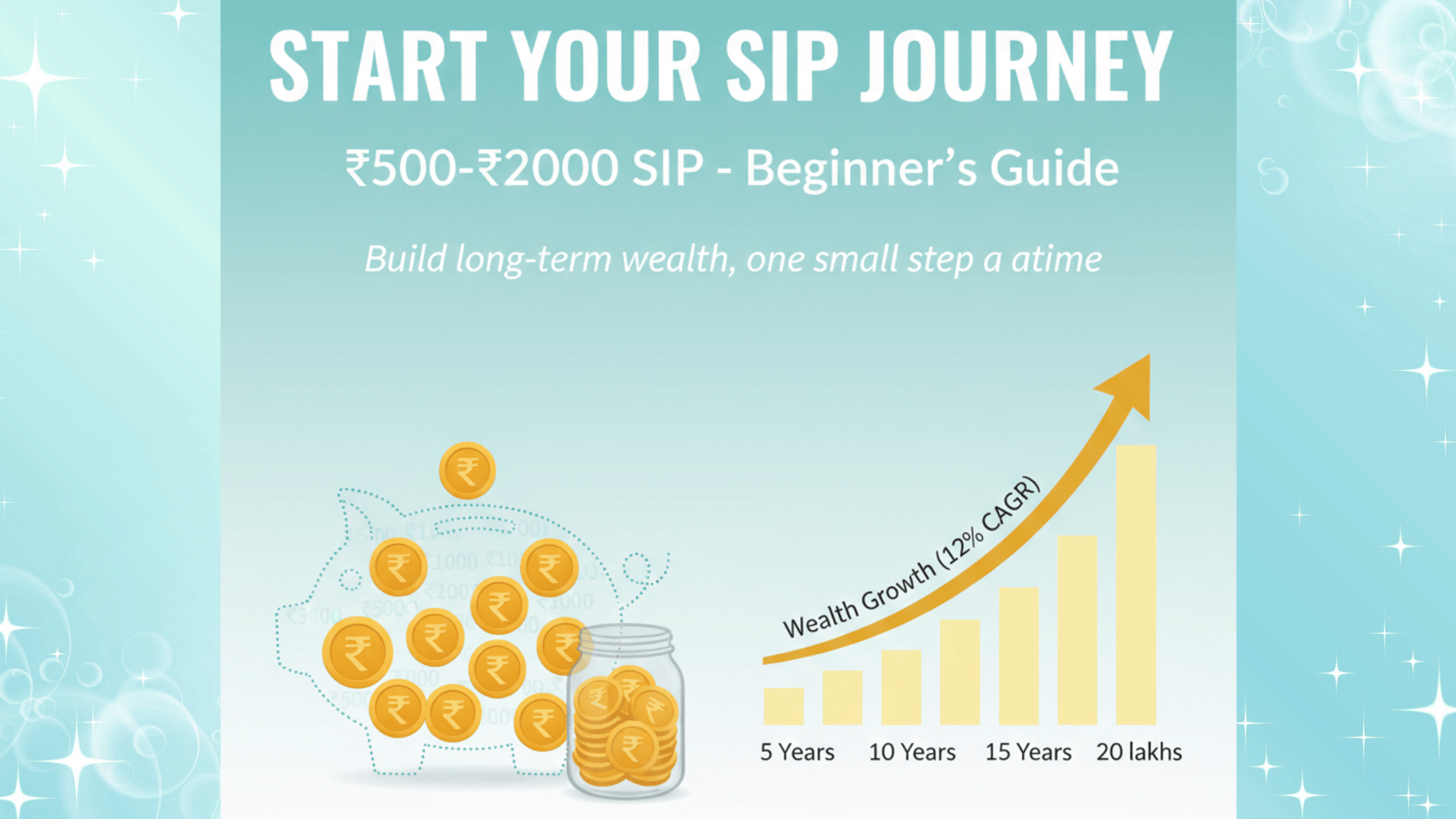

How SIP Fits into Monthly Budget Planning Formula for Indian Salaried People

SIP is the backbone of the Monthly Budget Planning Formula for Indian Salaried People.

Why?

Because:

-

It creates discipline

-

It builds wealth slowly

-

It beats inflation

Example:

₹5,000 SIP for 20 years at 12% return ≈ ₹50+ lakh corpus.

That’s the power of systematic investing.

Emergency Fund Rule in Monthly Budget Planning Formula for Indian Salaried People

Every Monthly Budget Planning Formula for Indian Salaried People must include:

👉 6–9 months of expenses saved in liquid funds or savings account.

If monthly expenses = ₹30,000

Emergency fund target = ₹1.8–2.7 lakh

This protects you from:

-

Job loss

-

Medical emergency

-

Unexpected expenses

Why Insurance Is Mandatory in Monthly Budget Planning Formula for Indian Salaried People

Insurance is not investment.

It is protection.

Your Monthly Budget Planning Formula for Indian Salaried People must include:

✔ Term Insurance (10–15x annual income)

✔ Health Insurance (Family floater)

Without protection, one medical emergency can destroy years of savings.

Advanced Monthly Budget Planning Formula for Indian Salaried People (For ₹1L+ Income)

If income is higher, increase:

-

Investment ratio to 30%

-

Wealth creation via equity mutual funds

-

Tax-saving planning under 80C

This upgraded Monthly Budget Planning Formula for Indian Salaried People accelerates financial freedom.

How Monthly Budget Planning Formula for Indian Salaried People Builds Long-Term Wealth

Consistency > Income size.

Even ₹3,000 SIP monthly for 25 years at 12% return ≈ ₹50 lakh+.

This is why Monthly Budget Planning Formula for Indian Salaried People works best when started early.

FAQs – Monthly Budget Planning Formula for Indian Salaried People

1. What is the best budget rule for Indian salaried people?

The modified 40-20-20-10-10 Monthly Budget Planning Formula for Indian Salaried People works best.

2. How much salary should be invested monthly?

Minimum 20%.

3. Is SIP necessary in monthly budgeting?

Yes, SIP ensures disciplined wealth building.

4. How to start budgeting with low salary?

Start small. Even ₹500 savings builds habit.

Final Thoughts: Start Your Monthly Budget Planning Formula for Indian Salaried People Today

Monthly Budget Planning Formula for Indian Salaried People is not complicated.

It only requires:

✔ Clarity

✔ Discipline

✔ Automation

If you are serious about financial growth, start today.

Because budgeting is not restriction.

It is financial freedom planning.

Want help creating a personalized Monthly Budget Planning Formula for Indian Salaried People based on your income?

👉 Get Free Financial Planning Consultation

👉 Start Your SIP Today

👉 Build Wealth Systematically

Contact Wealthifyme for goal-based investment planning and budgeting support.