Term Insurance vs Life Insurance: Key Differences Explained Clearly

February 3rd, 2026 Latest Blogs

Term Insurance vs Life Insurance: Key Differences Explained for Smart Financial Planning

Introduction: Term Insurance vs Life Insurance and Why This Comparison Matters

Understanding term insurance vs life insurance is one of the most important decisions in personal finance and insurance planning. Many people buy insurance without knowing the real difference, which is why learning term insurance vs life insurance helps you avoid costly mistakes. Choosing the right policy impacts your family’s financial security, long-term goals, and peace of mind.

What Is Term Insurance vs Life Insurance Explained Simply

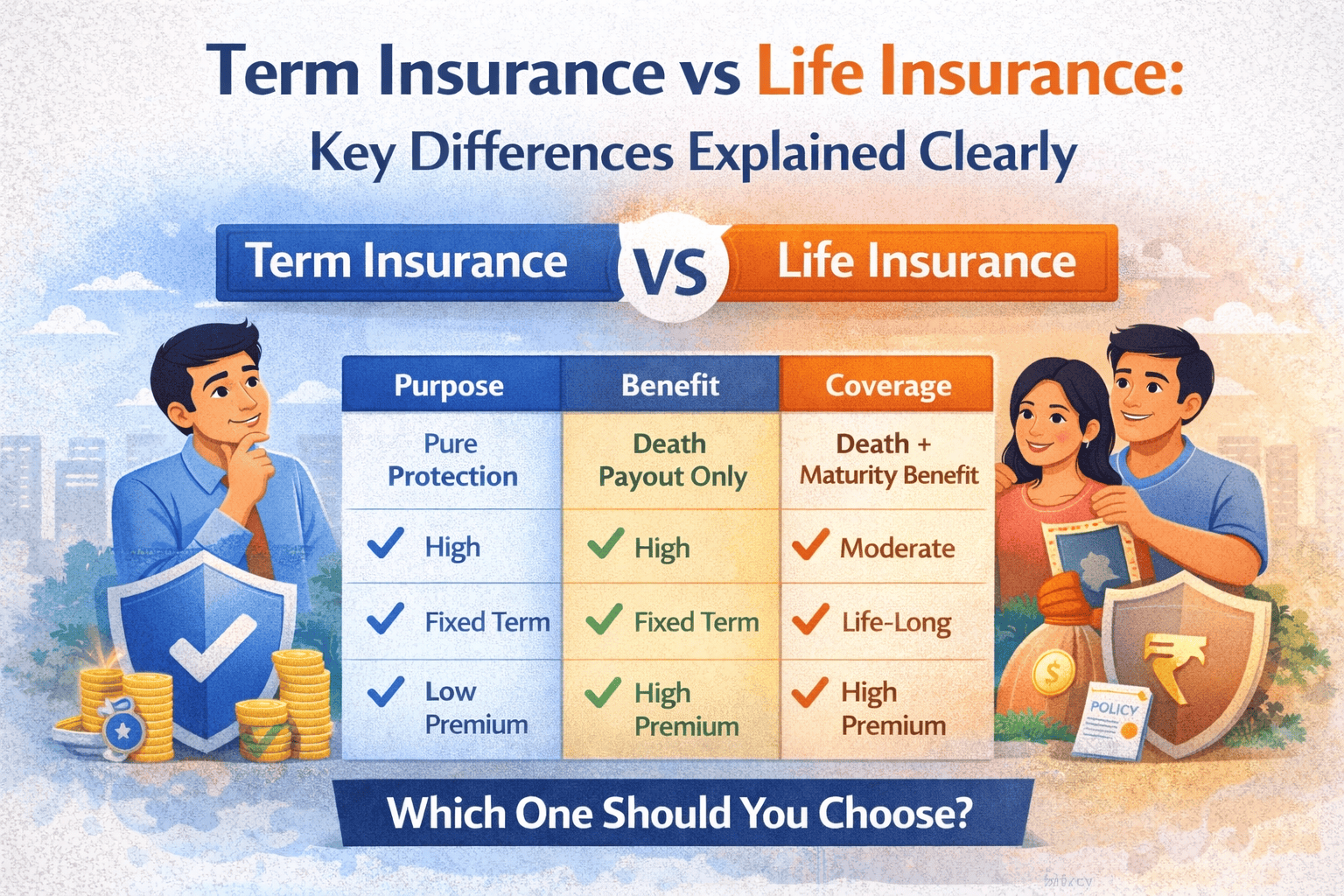

To clearly understand term insurance vs life insurance, you must know that term insurance provides pure life cover, while life insurance combines protection with savings or investment. This basic distinction is the foundation of the term insurance vs life insurance comparison and helps you decide based on your needs.

Why Understanding Term Insurance vs Life Insurance Is Important

The reason term insurance vs life insurance is important is because insurance is meant to protect dependents financially. Buying the wrong policy can result in low coverage or poor returns, which is why understanding term insurance vs life insurance ensures smarter financial decisions.

What Is Term Insurance vs Life Insurance from a Purpose Perspective

From a purpose point of view, term insurance vs life insurance differs significantly. Term insurance focuses only on risk protection, whereas life insurance focuses on both protection and savings. Knowing this purpose difference clarifies term insurance vs life insurance for beginners.

Term Insurance vs Life Insurance: Definition and Core Meaning

When comparing term insurance vs life insurance, term insurance is a policy that pays a sum assured only if the insured dies during the policy term. In contrast, life insurance pays either on death or maturity, which highlights a major difference in term insurance vs life insurance.

Term Insurance vs Life Insurance: Coverage Comparison

In the term insurance vs life insurance comparison, term insurance offers very high coverage at low premiums. Life insurance offers lower coverage for the same premium, which is why term insurance vs life insurance is often discussed among earning individuals.

Term Insurance vs Life Insurance: Premium Difference Explained

One of the biggest reasons people compare term insurance vs life insurance is premium cost. Term insurance premiums are affordable, while life insurance premiums are higher due to the savings component, which makes term insurance vs life insurance a cost-efficiency debate.

Term Insurance vs Life Insurance: Policy Duration Comparison

When evaluating term insurance vs life insurance, term insurance runs for a fixed period like 20 or 30 years. Life insurance policies may run until maturity or even lifelong, which is another key difference in term insurance vs life insurance.

Term Insurance vs Life Insurance: Maturity Benefit Explained

A crucial difference in term insurance vs life insurance is maturity benefit. Term insurance does not pay anything if the policyholder survives the term, whereas life insurance provides a maturity payout, clearly separating term insurance vs life insurance outcomes.

Term Insurance vs Life Insurance: Death Benefit Comparison

Both policies pay on death, but in term insurance vs life insurance, term insurance usually pays a higher sum assured. Life insurance pays a lower amount but may include bonuses, which again highlights term insurance vs life insurance differences.

Term Insurance vs Life Insurance: Investment Angle Explained

People often misunderstand term insurance vs life insurance by treating insurance as investment. Term insurance is not an investment, while life insurance includes an investment or savings element, which is why term insurance vs life insurance must be chosen carefully.

Term Insurance vs Life Insurance: Returns Comparison

In the term insurance vs life insurance comparison, term insurance gives no returns if the policyholder survives. Life insurance offers moderate returns, usually lower than mutual funds, which clarifies the return aspect of term insurance vs life insurance.

Term Insurance vs Life Insurance: Tax Benefits Explained

Tax benefits apply in both cases, but term insurance vs life insurance differs in effectiveness. Premiums are deductible under Section 80C, and death benefits are tax-free, making term insurance vs life insurance equal in tax treatment.

Term Insurance vs Life Insurance: Flexibility and Riders

When comparing term insurance vs life insurance, term insurance offers flexible riders like critical illness and accidental cover. Life insurance also offers riders, but at a higher cost, reinforcing term insurance vs life insurance cost efficiency.

Term Insurance vs Life Insurance: Who Should Choose Term Insurance

Understanding term insurance vs life insurance helps identify that term insurance is ideal for earning individuals with dependents. If income protection is the goal, term insurance vs life insurance clearly favours term insurance.

Term Insurance vs Life Insurance: Who Should Choose Life Insurance

In the term insurance vs life insurance debate, life insurance suits individuals who want forced savings along with insurance. Conservative investors often prefer this side of term insurance vs life insurance.

Term Insurance vs Life Insurance: Suitability by Age

Age plays a big role in term insurance vs life insurance decisions. Younger individuals benefit more from term insurance due to low premiums, while older individuals may consider life insurance, which is why term insurance vs life insurance must be age-appropriate.

Term Insurance vs Life Insurance: Family Protection Example

Consider a 30-year-old earning ₹50,000 per month. In term insurance vs life insurance, term insurance can provide ₹1 crore cover cheaply, while life insurance may provide much less cover, clearly showing term insurance vs life insurance impact on family protection.

Term Insurance vs Life Insurance: Cost-Benefit Analysis

From a cost-benefit angle, term insurance vs life insurance favours term insurance for protection and separate investments for wealth creation. Mixing both can reduce efficiency, which is why term insurance vs life insurance clarity is essential.

Term Insurance vs Life Insurance: Common Myths Explained

Many myths exist around term insurance vs life insurance, such as “term insurance is waste of money.” In reality, protection itself is valuable, proving term insurance vs life insurance myths need correction.

Term Insurance vs Life Insurance: Insurance Is Not Investment

One key lesson from term insurance vs life insurance is that insurance should not replace investments. Term insurance plus mutual funds often outperform life insurance returns, which strengthens the term insurance vs life insurance argument.

Term Insurance vs Life Insurance: Impact on Long-Term Financial Planning

In long-term planning, term insurance vs life insurance decisions affect cash flow and goals. Term insurance keeps premiums low, freeing money for investments, which is a major advantage in term insurance vs life insurance planning.

Term Insurance vs Life Insurance: Mistakes to Avoid

Common mistakes in term insurance vs life insurance include buying inadequate cover or mixing goals. Understanding term insurance vs life insurance helps avoid underinsurance and poor returns.

Term Insurance vs Life Insurance: How to Choose the Right One

To decide between term insurance vs life insurance, assess income, dependents, liabilities, and goals. A clear evaluation makes the term insurance vs life insurance choice easier and more logical.

Term Insurance vs Life Insurance: Expert Recommendation

Most financial experts recommend term insurance for protection and separate investments for wealth creation, which settles the term insurance vs life insurance debate for most working professionals.

Final Thoughts: Term Insurance vs Life Insurance Explained Clearly

In conclusion, understanding term insurance vs life insurance helps you protect your family and plan finances effectively. Term insurance offers high protection at low cost, while life insurance combines savings with cover. Choosing wisely based on goals is the true essence of term insurance vs life insurance.

WealthifyMe Expert Tip

At WealthifyMe, we help you:

✔ Choose the right insurance

✔ Calculate ideal coverage

✔ Avoid mis-selling

✔ Build a complete financial plan

📞 Talk to a WealthifyMe advisor today and make the right insurance choice.