How to Start SIP with Small Monthly Amounts ₹500–₹2000 SIP

February 4th, 2026 News

How to Start SIP with Small Monthly Amounts ₹500–₹2000 SIP – Complete Beginner Guide with SIP Growth Chart

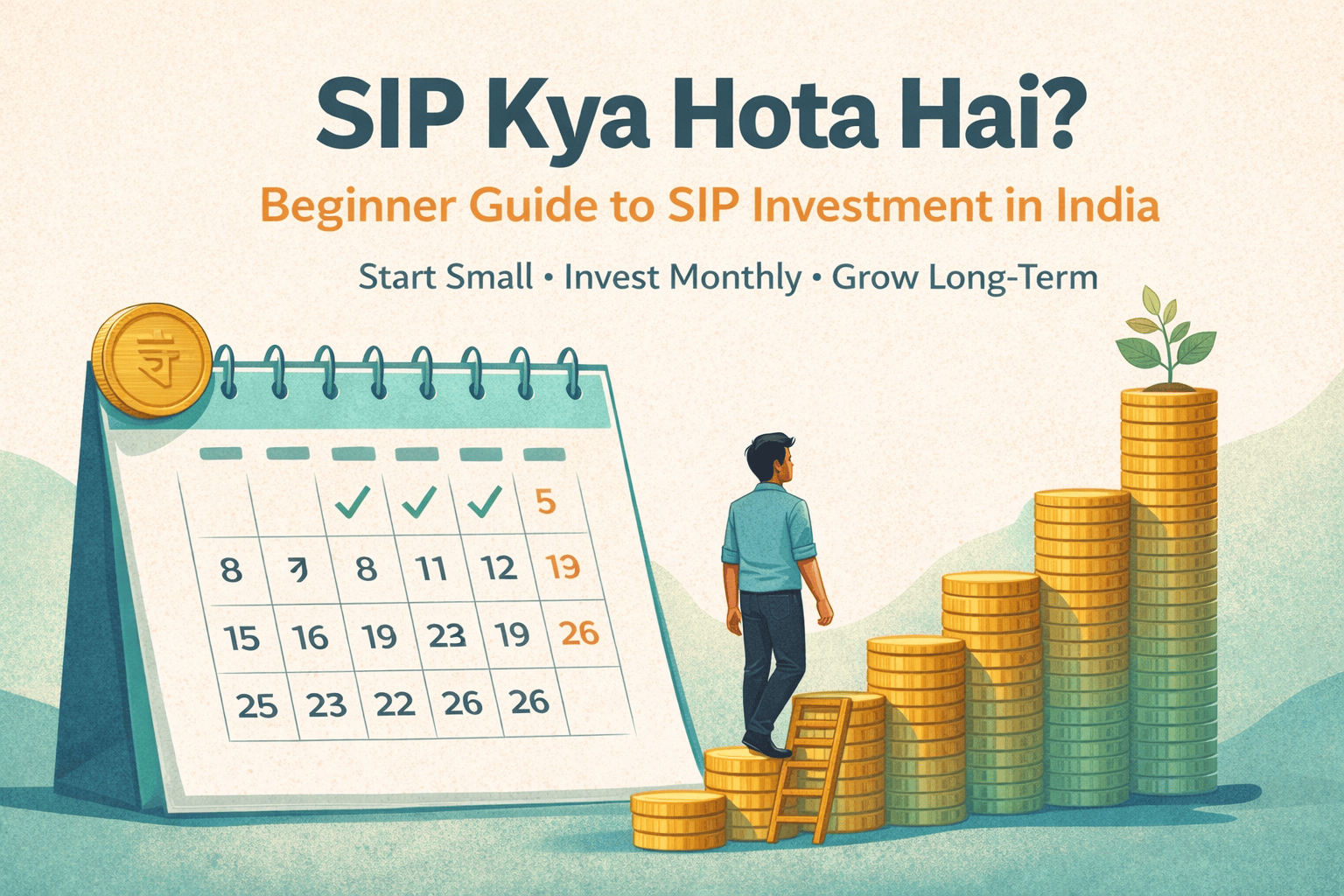

Starting wealth creation doesn’t require a big salary or huge savings. With ₹500–₹2000 SIP, anyone can begin investing smartly and build long-term financial security. This detailed guide explains how to start SIP with small monthly amounts ₹500–₹2000 SIP, how it works, its benefits, and how a SIP growth chart shows the power of consistency over time.

What Is SIP and Why ₹500–₹2000 SIP Is Perfect for Beginners

A Systematic Investment Plan allows you to invest a fixed amount every month into mutual funds. A ₹500–₹2000 SIP is ideal for students, freshers, freelancers, and first-time investors who want to start small without financial pressure. With ₹500–₹2000 SIP, you learn discipline, reduce risk, and slowly grow wealth.

How ₹500–₹2000 SIP Works in Mutual Funds

In a ₹500–₹2000 SIP, a fixed amount is automatically invested each month into a selected mutual fund. Whether the market is up or down, your ₹500–₹2000 SIP continues buying units, which helps average out costs and build wealth gradually.

Why You Should Start ₹500–₹2000 SIP Early in Life

Starting a ₹500–₹2000 SIP early gives you the biggest advantage—time. Compounding works best when investments stay longer. Even a small ₹500–₹2000 SIP started at age 22 can outperform a larger investment started late.

Benefits of Investing Through ₹500–₹2000 SIP

A ₹500–₹2000 SIP offers multiple benefits like affordability, flexibility, and long-term growth. With ₹500–₹2000 SIP, you don’t need market expertise, and you can pause, increase, or stop anytime without penalties.

Who Should Invest in ₹500–₹2000 SIP

A ₹500–₹2000 SIP is suitable for college students, fresh job holders, homemakers, gig workers, and anyone who wants to start investing with minimal risk. If saving money feels difficult, ₹500–₹2000 SIP is your best first step.

Step-by-Step Process to Start ₹500–₹2000 SIP

Starting a ₹500–₹2000 SIP is simple and fully digital. Choose a platform, complete KYC, select a mutual fund, set your SIP amount, and start investing. A ₹500–₹2000 SIP can be started within 10 minutes.

Best Mutual Funds for ₹500–₹2000 SIP Investment

For a ₹500–₹2000 SIP, beginners should prefer large-cap, index, or balanced funds. These funds provide stability and steady returns, making ₹500–₹2000 SIP safer for first-time investors.

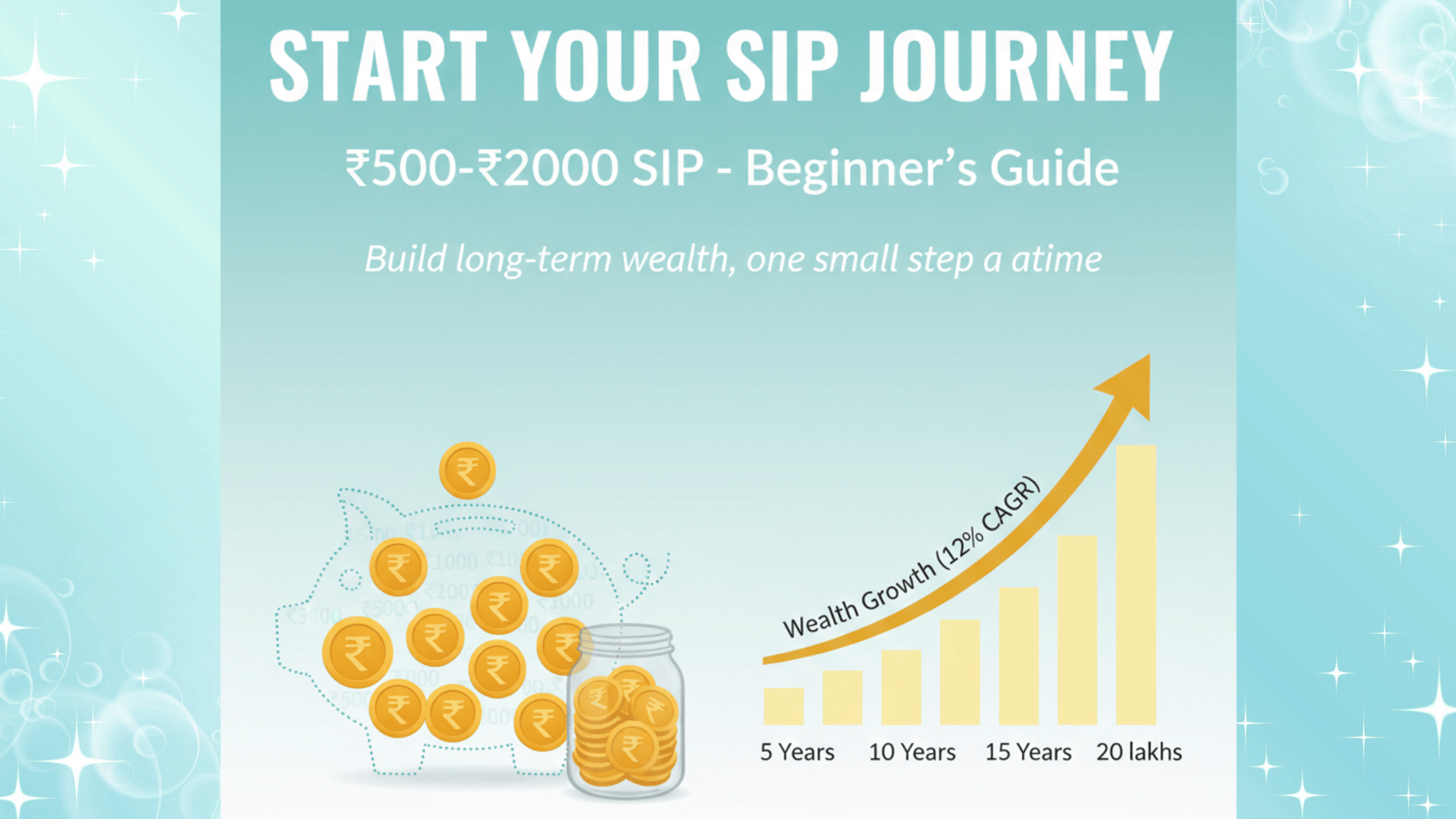

₹500–₹2000 SIP Growth Chart Explained Simply

A ₹500–₹2000 SIP growth chart visually shows how small investments grow over time. A monthly ₹500 SIP for 20 years at 12% returns can grow into lakhs, proving how powerful a ₹500–₹2000 SIP can be.

Example of ₹500–₹2000 SIP Growth Chart Over Time

A ₹500–₹2000 SIP growth chart example: investing ₹1,000 monthly for 25 years totals ₹3,00,000 invested, but the final value can exceed ₹10 lakhs. This is why ₹500–₹2000 SIP is considered one of the smartest financial habits.

Power of Compounding in ₹500–₹2000 SIP

Compounding is the backbone of ₹500–₹2000 SIP growth. Returns generate further returns, and over years, your ₹500–₹2000 SIP grows faster than expected. Time is the biggest multiplier in SIP investing.

How Market Volatility Benefits ₹500–₹2000 SIP Investors

Market ups and downs actually help ₹500–₹2000 SIP investors through rupee cost averaging. When markets fall, your ₹500–₹2000 SIP buys more units, improving long-term returns.

Common Mistakes to Avoid While Starting ₹500–₹2000 SIP

Many investors stop their ₹500–₹2000 SIP during market corrections. This is a mistake. Consistency is the key to making ₹500–₹2000 SIP successful over long periods.

How Long Should You Continue ₹500–₹2000 SIP

To see real results from ₹500–₹2000 SIP, a minimum of 10–15 years is recommended. The longer your ₹500–₹2000 SIP runs, the more powerful compounding becomes.

Tax Benefits of Investing Through ₹500–₹2000 SIP

Certain funds under ₹500–₹2000 SIP, like ELSS, offer tax benefits under Section 80C. Along with wealth creation, ₹500–₹2000 SIP can also help reduce tax liability.

How to Increase Wealth by Stepping Up ₹500–₹2000 SIP

Once income increases, you can step up your ₹500–₹2000 SIP annually. Increasing SIP amount by even 10% boosts the final value of your ₹500–₹2000 SIP significantly.

SIP vs Lump Sum: Why ₹500–₹2000 SIP Is Better

A ₹500–₹2000 SIP is safer than lump-sum investing because it spreads risk across market cycles. For beginners, ₹500–₹2000 SIP is more disciplined and stress-free.

How ₹500–₹2000 SIP Helps Achieve Financial Goals

Whether it’s buying a bike, building an emergency fund, or planning retirement, ₹500–₹2000 SIP helps convert dreams into achievable goals through systematic investing.

Online Platforms to Start ₹500–₹2000 SIP in India

You can start ₹500–₹2000 SIP through AMC websites, mutual fund apps, or financial advisors. Digital platforms make ₹500–₹2000 SIP easy, transparent, and paperless.

Role of Financial Advisor in ₹500–₹2000 SIP Planning

A financial advisor helps select the right fund for your ₹500–₹2000 SIP, based on risk profile and goals. Proper guidance improves the success of ₹500–₹2000 SIP investments.

Why Discipline Matters in ₹500–₹2000 SIP Success

Missing SIP installments breaks the compounding cycle. Discipline is crucial for ₹500–₹2000 SIP success, as consistency creates long-term wealth.

Real-Life Example of ₹500–₹2000 SIP Investor

A young professional investing ₹2,000 monthly through ₹500–₹2000 SIP for 20 years can accumulate a corpus large enough for major life goals. This shows how powerful ₹500–₹2000 SIP truly is.

Myths About ₹500–₹2000 SIP You Should Ignore

Many believe ₹500–₹2000 SIP is too small to matter. In reality, ₹500–₹2000 SIP is the best way to start investing without fear or pressure.

Final Thoughts on Starting ₹500–₹2000 SIP Today

Starting a ₹500–₹2000 SIP today is better than waiting for the perfect time. Small steps lead to big results, and ₹500–₹2000 SIP proves that wealth is built through consistency, patience, and smart planning.