What Is an Emergency Fund & How Much Should You Save for Financial Security

February 2nd, 2026 Latest Blogs

What Is an Emergency Fund & How Much Should You Save: A Complete Guide for Financial Security

Introduction: What Is an Emergency Fund & How Much Should You Save in Today’s Uncertain Life

Understanding what is an emergency fund & how much should you save is one of the most important steps in personal finance, especially in today’s uncertain economic environment. Medical emergencies, job loss, sudden repairs, or family responsibilities can arise anytime, and knowing what is an emergency fund & how much should you save helps you stay financially stable without stress or debt.

What Is an Emergency Fund & How Much Should You Save Explained Simply

To understand what is an emergency fund & how much should you save, you need to know that an emergency fund is money kept aside only for unexpected situations. This fund is not for vacations or shopping, and learning what is an emergency fund & how much should you save ensures that you do not depend on loans or credit cards during emergencies.

Why What Is an Emergency Fund & How Much Should You Save Matters More Than Ever

The reason what is an emergency fund & how much should you save matters today is because income sources are no longer fully secure. Layoffs, medical costs, and rising inflation make it essential to understand what is an emergency fund & how much should you save to protect your lifestyle and savings.

What Is an Emergency Fund & How Much Should You Save for Financial Peace of Mind

When you know what is an emergency fund & how much should you save, you gain peace of mind because you are prepared for the unexpected. This preparation allows you to focus on long-term investments without panic, which is why understanding what is an emergency fund & how much should you save is the foundation of financial planning.

What Is an Emergency Fund & How Much Should You Save Based on Your Monthly Expenses

A simple rule to understand what is an emergency fund & how much should you save is to calculate your monthly expenses. Financial experts suggest saving 3 to 6 months of expenses, and knowing what is an emergency fund & how much should you save helps you decide the exact amount based on your lifestyle.

What Is an Emergency Fund & How Much Should You Save If You Are Salaried

If you are a salaried professional, understanding what is an emergency fund & how much should you save becomes easier because income is fixed. Generally, salaried individuals should save at least 6 months of expenses, and knowing what is an emergency fund & how much should you save ensures job loss does not affect daily life.

What Is an Emergency Fund & How Much Should You Save If You Are Self-Employed

For freelancers or business owners, what is an emergency fund & how much should you save becomes even more critical due to irregular income. Experts recommend saving 9–12 months of expenses, and understanding what is an emergency fund & how much should you save protects you during low-income periods.

What Is an Emergency Fund & How Much Should You Save for Families

Families have higher responsibilities, which is why what is an emergency fund & how much should you save must include dependents’ needs. Medical bills, school fees, and household expenses make it necessary to understand what is an emergency fund & how much should you save with a larger safety buffer.

What Is an Emergency Fund & How Much Should You Save for Singles

For single individuals, knowing what is an emergency fund & how much should you save helps maintain independence during emergencies. Even without dependents, rent, food, and healthcare costs make it essential to understand what is an emergency fund & how much should you save realistically.

What Is an Emergency Fund & How Much Should You Save to Avoid Debt

One major benefit of understanding what is an emergency fund & how much should you save is avoiding high-interest debt. Without an emergency fund, people rely on credit cards or personal loans, which is why knowing what is an emergency fund & how much should you save protects your financial health.

What Is an Emergency Fund & How Much Should You Save vs Using Credit Cards

Many people confuse credit cards with emergency funds, but what is an emergency fund & how much should you save teaches you that borrowed money is not a solution. Credit cards charge interest, while understanding what is an emergency fund & how much should you save ensures interest-free protection.

What Is an Emergency Fund & How Much Should You Save and Where to Keep It

Knowing what is an emergency fund & how much should you save also means knowing where to store it. The fund should be kept in a savings account, liquid fund, or short-term FD, and understanding what is an emergency fund & how much should you save ensures quick access to cash.

What Is an Emergency Fund & How Much Should You Save in Savings Account

Keeping your emergency fund in a savings account makes sense when you understand what is an emergency fund & how much should you save. Savings accounts offer instant liquidity, which is essential once you truly understand what is an emergency fund & how much should you save.

What Is an Emergency Fund & How Much Should You Save in Liquid Mutual Funds

Liquid mutual funds are another option when learning what is an emergency fund & how much should you save. These funds offer better returns than savings accounts, and understanding what is an emergency fund & how much should you save helps you balance safety and returns.

What Is an Emergency Fund & How Much Should You Save and What Not to Do

Understanding what is an emergency fund & how much should you save also includes knowing what not to do. Avoid investing emergency money in stocks or long-term funds, because knowing what is an emergency fund & how much should you save means prioritising safety over returns.

What Is an Emergency Fund & How Much Should You Save Step-by-Step

To truly apply what is an emergency fund & how much should you save, start small and increase gradually. Begin with one month’s expenses, then build towards six months, because understanding what is an emergency fund & how much should you save is a gradual process.

What Is an Emergency Fund & How Much Should You Save with a Monthly Plan

A monthly savings plan helps implement what is an emergency fund & how much should you save without pressure. Automating savings ensures discipline, and understanding what is an emergency fund & how much should you save makes consistency easier.

What Is an Emergency Fund & How Much Should You Save and Inflation Impact

Inflation reduces purchasing power, which is why what is an emergency fund & how much should you save must be reviewed annually. Updating your emergency fund ensures that understanding what is an emergency fund & how much should you save stays relevant over time.

What Is an Emergency Fund & How Much Should You Save for Medical Emergencies

Medical emergencies are the biggest reason people understand what is an emergency fund & how much should you save. Hospital bills can drain savings quickly, and knowing what is an emergency fund & how much should you save prevents financial shock.

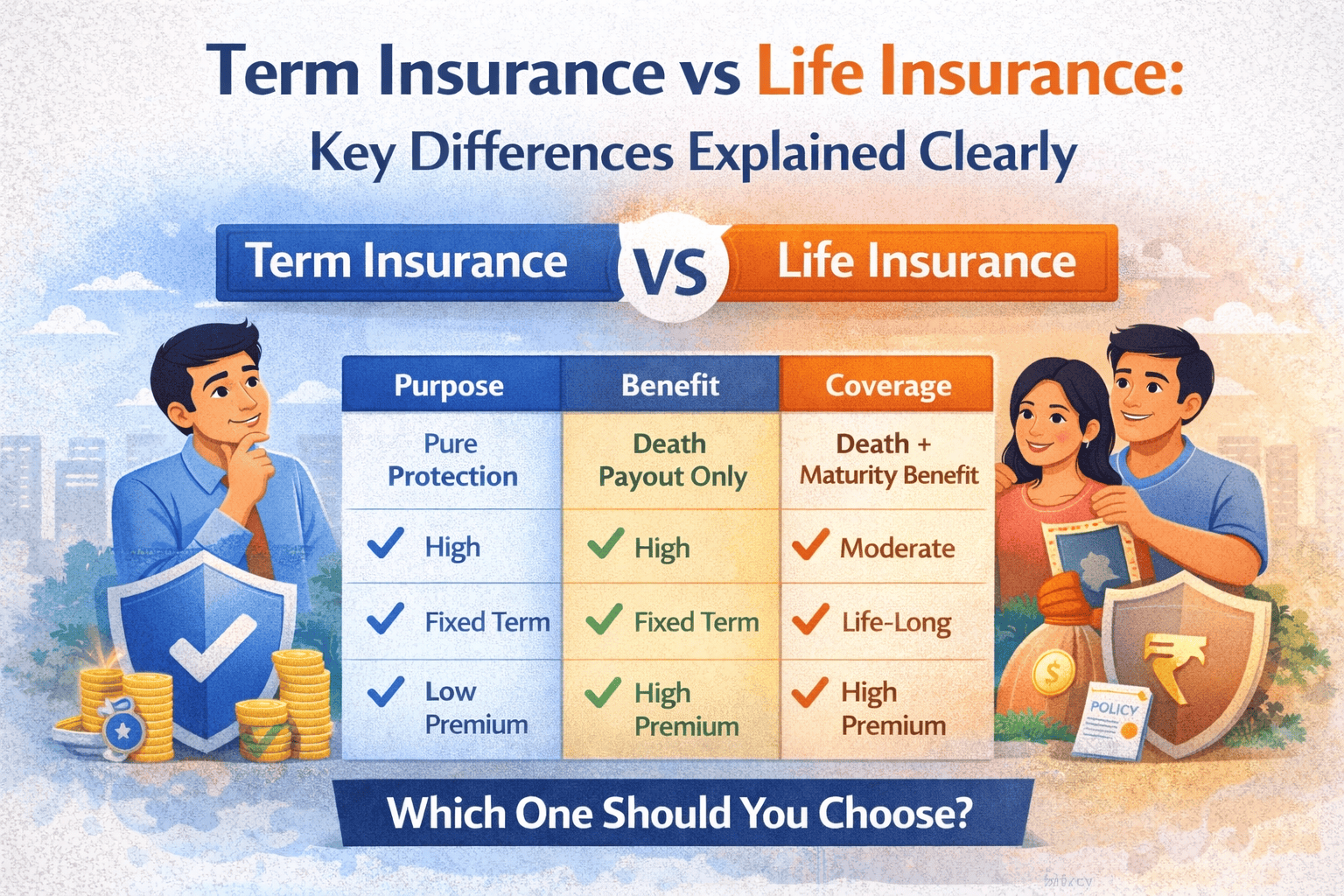

What Is an Emergency Fund & How Much Should You Save Alongside Insurance

Even with insurance, deductibles and uncovered expenses exist, which is why what is an emergency fund & how much should you save remains important. Insurance and emergency funds work together, and understanding what is an emergency fund & how much should you save completes your safety net.

What Is an Emergency Fund & How Much Should You Save for Job Loss

Job loss is unpredictable, making what is an emergency fund & how much should you save essential for survival without panic. A strong emergency fund gives time to find new opportunities, proving why what is an emergency fund & how much should you save matters.

What Is an Emergency Fund & How Much Should You Save for Long-Term Stability

Long-term stability begins with understanding what is an emergency fund & how much should you save. Without it, even strong investments fail during crises, which is why what is an emergency fund & how much should you save is the first step in wealth building.

Common Mistakes While Understanding What Is an Emergency Fund & How Much Should You Save

Many people delay saving or invest emergency money, which shows poor understanding of what is an emergency fund & how much should you save. Avoiding these mistakes ensures that what is an emergency fund & how much should you save works as intended.

Final Thoughts: What Is an Emergency Fund & How Much Should You Save for a Secure Future

In conclusion, understanding what is an emergency fund & how much should you save is not optional—it is essential. Whether you are young, married, salaried, or self-employed, knowing what is an emergency fund & how much should you save protects your income, savings, and peace of mind.