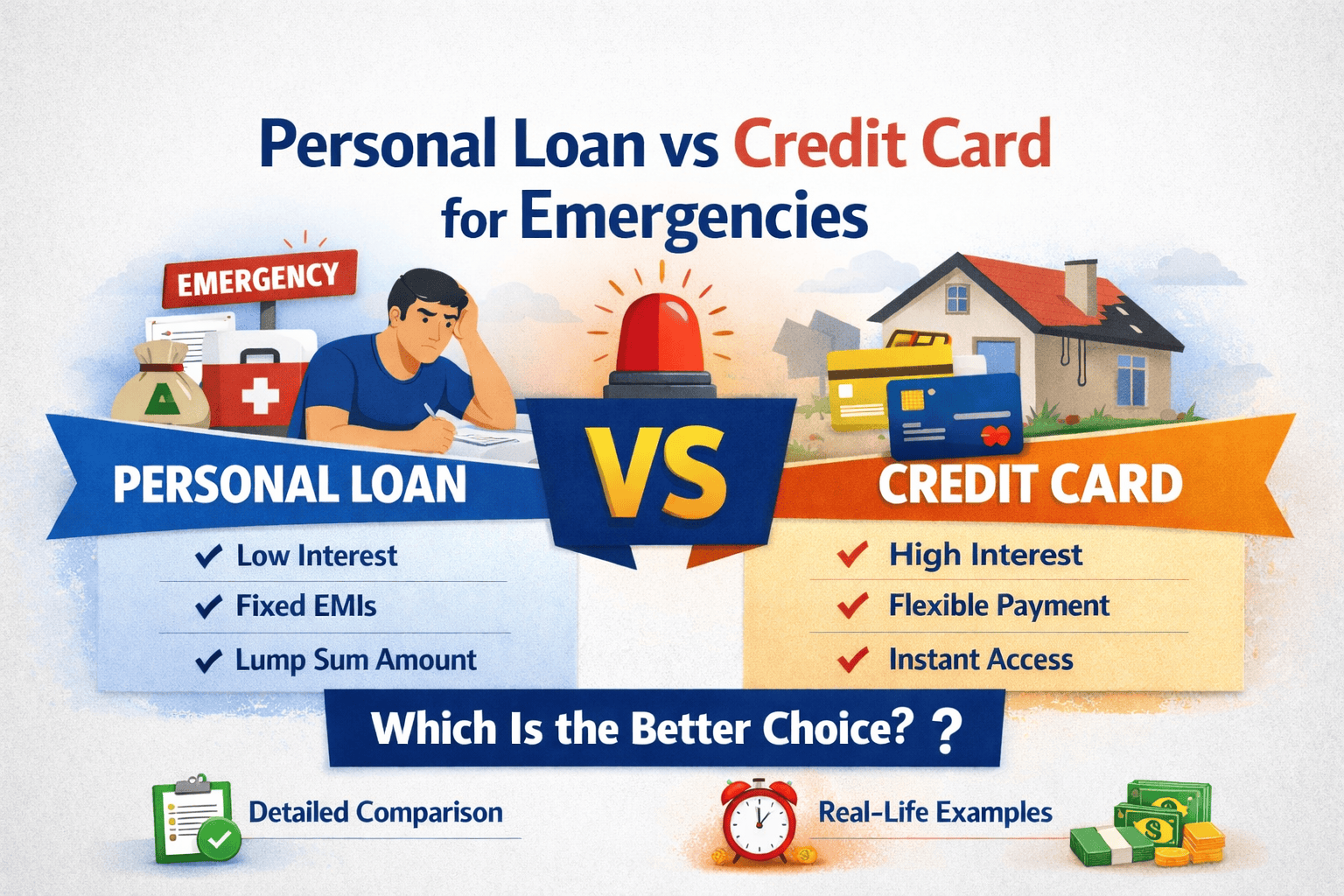

Personal Loan vs Credit Card for Emergencies: Which Is the Better Choice?

January 29th, 2026 Latest Blogs

Personal Loan vs Credit Card for Emergencies: Which Is Better for Emergencies in India?

Emergencies never come with a warning. Whether it is a medical issue, sudden job loss, urgent home repair, or an unexpected travel need, arranging money quickly becomes the top priority. In such situations, most Indians usually depend on two common borrowing options—personal loans and credit cards.

But the big question remains: Personal Loan vs Credit Card for Emergencies – which is better for emergencies?

Choosing the wrong option can increase your financial stress instead of solving it.

In this detailed guide by WealthifyMe, we will explain Personal Loan vs Credit Card for Emergencies with real-life examples, interest comparisons, repayment impact, and expert insights so you can make a smart and confident decision.

Understanding the Emergency Finance Problem in India

When facing a crisis, people often make quick financial decisions without understanding the long-term impact. This is why the topic Personal Loan vs Credit Card for Emergencies is extremely important for Indian households.

Emergencies usually require:

-

Fast access to funds

-

Minimal documentation

-

Flexible repayment options

Both personal loans and credit cards promise quick money, but the cost and risk differ significantly. Understanding Personal Loan vs Credit Card for Emergencies before borrowing can save you thousands of rupees.

What Is a Personal Loan? (Emergency Perspective)

A personal loan is an unsecured loan provided by banks or NBFCs for any purpose, including emergencies. In the Personal Loan vs Credit Card for Emergencies debate, personal loans are often chosen for large, planned emergency expenses.

Key Features of Personal Loans

-

Fixed loan amount

-

Fixed EMI and tenure

-

Interest rates lower than credit cards

-

Suitable for large emergency expenses

In the context of Personal Loan vs Credit Card for Emergencies, personal loans offer stability and predictable repayment.

What Is a Credit Card? (Emergency Perspective)

A credit card allows you to borrow instantly up to a predefined limit. In Personal Loan vs Credit Card for Emergencies, credit cards are usually preferred for instant and short-term needs.

Key Features of Credit Cards

-

Instant access to funds

-

Interest-free period (if paid on time)

-

High interest if balance is unpaid

-

Flexible spending

While credit cards are convenient, the Personal Loan vs Credit Card for Emergencies comparison shows they can be expensive if misused.

Personal Loan vs Credit Card for Emergencies: Quick Comparison Table

| Factor | Personal Loan | Credit Card |

|---|---|---|

| Access Speed | 1–3 days | Instant |

| Interest Rate | 10%–18% p.a. | 30%–45% p.a. |

| Best For | Large emergencies | Small, urgent expenses |

| Repayment | Fixed EMI | Flexible but risky |

| Impact on Credit Score | Positive if paid on time | Can drop quickly |

| Processing | Documentation required | No documentation |

This table clearly highlights Personal Loan vs Credit Card for Emergencies differences in a simple way.

Real-Life Example 1: Medical Emergency

Let’s understand Personal Loan vs Credit Card for Emergencies with a real example.

Situation:

Ravi, age 35, faces a sudden medical emergency costing ₹3,00,000.

Option 1: Credit Card

-

Interest rate: 36% per year

-

Monthly interest: ~3%

-

High risk of debt trap

Option 2: Personal Loan

-

Interest rate: 13% per year

-

EMI for 3 years: ~₹10,100

-

Predictable and affordable

✅ Conclusion: In Personal Loan vs Credit Card for Emergencies, personal loans are better for large medical expenses.

Real-Life Example 2: Short-Term Cash Need

Situation:

Neha needs ₹20,000 urgently for travel due to a family emergency.

Credit Card Advantage:

-

Instant payment

-

Can repay within 30 days

-

Zero interest if paid fully

Personal Loan Disadvantage:

-

Not practical for small amount

-

Processing time required

✅ Conclusion: In Personal Loan vs Credit Card for Emergencies, credit cards work better for short-term, small emergencies.

Interest Rate Comparison: Personal Loan vs Credit Card for Emergencies

Interest is the most critical factor in Personal Loan vs Credit Card for Emergencies.

-

Personal loan interest: 10%–18% annually

-

Credit card interest: 2.5%–3.75% monthly

A small delay in repayment on a credit card can make it far more expensive than a personal loan. That’s why Personal Loan vs Credit Card for Emergencies should never be decided only on convenience.

Repayment Impact on Monthly Budget

When comparing Personal Loan vs Credit Card for Emergencies, repayment discipline matters.

Personal Loan

-

Fixed EMI

-

Easier budgeting

-

Less mental stress

Credit Card

-

Minimum due trap

-

Interest compounding

-

Budget imbalance

For long-term emergencies, Personal Loan vs Credit Card for Emergencies clearly favors personal loans.

Credit Score Impact: A Hidden Factor

Your credit score plays a major role in future loans.

In Personal Loan vs Credit Card for Emergencies:

-

Timely EMI payment improves score

-

Credit card overuse lowers score quickly

Many people damage their credit score by choosing credit cards in emergencies without a repayment plan.

When Should You Choose a Personal Loan?

Choose a personal loan in Personal Loan vs Credit Card for Emergencies if:

-

Expense is above ₹50,000

-

Repayment needed over months or years

-

You want lower interest

-

You need financial stability

Personal loans are safer for structured emergency planning.

When Should You Choose a Credit Card?

Choose a credit card in Personal Loan vs Credit Card for Emergencies if:

-

Amount is small

-

You can repay within 30–45 days

-

Emergency is immediate

-

No processing time available

Used wisely, credit cards can be helpful emergency tools.

Common Mistakes People Make During Emergencies

In Personal Loan vs Credit Card for Emergencies, avoid these mistakes:

-

Paying only minimum due

-

Ignoring interest rates

-

Borrowing without repayment plan

-

Using multiple credit cards

Emergency borrowing without planning can lead to long-term financial stress.

Expert Tip from WealthifyMe

According to WealthifyMe advisors, the best approach to Personal Loan vs Credit Card for Emergencies is:

-

First use emergency savings

-

Then evaluate loan amount

-

Choose credit card only for short-term

-

Use personal loan for large expenses

Preparedness is the key.

How to Avoid Emergency Borrowing Altogether

While understanding Personal Loan vs Credit Card for Emergencies is important, avoiding debt is even better.

Build:

-

Emergency fund (6 months expenses)

-

Health insurance

-

Term insurance

This reduces dependency on both options.

Final Verdict: Personal Loan vs Credit Card for Emergencies

So, Personal Loan vs Credit Card for Emergencies – which is better for emergencies?

✔ Personal Loan – Best for large, long-term emergencies

✔ Credit Card – Best for small, short-term urgent needs

There is no single winner. The right choice depends on amount, urgency, and repayment capacity.

Need Help Choosing the Right Emergency Option?

At WealthifyMe, we help you:

-

Compare loan options

-

Improve credit score

-

Plan emergency funds

-

Choose cost-effective borrowing

📞 Talk to a WealthifyMe Financial Advisor today and make smarter money decisions before emergencies strike